Desk booking has become a popular topic with companies realizing that flexible working and hybrid workplaces are here to stay. But is it just a buzzword? Or is this something businesses around the world should be adopting as we adjust to the new normal of the office environment? Whether you’re looking for more information about desk booking or are considering implementing a desk-booking system in your office, we’ve compiled a list of important things for you to consider. If you want to learn more about the changes that are coming to the workplace, take a look at this webinar with Memoori: The idea behind this premise is that employees are able to reserve their workspace ahead of time. This allows offices to keep their number of desks to a minimum and their rental costs low. During the pandemic, desk booking catered to a new need; companies wanted to comply with safety measures while ensuring the employees who came into the office felt confident that they would have a workspace to use. You may have also come across the concept of hot desking, which also allows one desk to be used for multiple shifts throughout the day. Employee A could come in from 7am to 10am and attend a meeting outside the office during the afternoon. Afterwards, employee B could use the same desk from 4pm – 6pm. In theory, both hot desking and desk-booking concepts sound like appealing and efficient solutions. In practice, the idea is unlikely to work as seamlessly as one might initially think. These are some of the questions that you should ask when considering a desk-booking software: Think about the utilization of your organization’s meeting rooms. Chances are they’re bookable, right? However, are you aware of how many no-shows your meeting rooms see every day? Employees frequently book a room only to host the meeting in a café or to take clients out to a restaurant. In some cases, people reserve a room, but realize that no one is in the office. In the end, they conduct the meeting virtually. Bookings can even occur by accident without employees realizing that they have reserved a space. This not only prevents other people from booking the room, but in the end, the space never actually gets used. If these problems already exist within your workplace, you can expect to see similar occurrences when a new tool is implemented, which could be a costly problem for the business. An important factor to successfully implementing new technology in the workplace is having the whole team on board with the process. This means that new systems should be straightforward and easy to add into existing routines. More importantly, they should also provide clear advantages for the users. If the employees don’t feel that there is an existing problem or a true need for a desk-booking tool, forcing it upon them will only cause frustration. On top of that, it might even end up wasting the company’s time. A reservation tool could simply end up being more trouble than it’s worth, if there is no buy-in from the entire team. With desk booking, a set of rules must be implemented so companies can keep the experience efficient and employees can better understand the systems in use. Unfortunately, people don’t always follow the rules. It’s possible that employees might find loopholes in the system and try to use them to their advantage. Some staff may book desks for an entire week but only come into the office for 3 days; others may book a desk for 8 hours but only use it for 2. Both scenarios are examples of inefficient space usage. The bottom line is that implementing a desk-booking system may generate more work than value! A common reason for companies to provide a flexible desk system is to encourage more interaction between departments. The hope is that it can ultimately foster more innovation within the company. If this is a goal, then desk booking can be a slippery slope. In theory, the company can encourage people to move around regularly. Realistically, if employees are able to book far in advance, they may always try to take their preferred spot or book desks near the same people every time. The intended result of improved interaction may not happen at all, and by discouraging spontaneity, a reservation tool may make collaboration even more difficult to achieve. The bottom line here is: think about the ramifications of a desk-booking system on your company culture. Short term, particularly in the face of COVID-19, the option to reserve a spot can be helpful. It helps employees feel confident that there won’t be too many people when they arrive the next day at work. It can also assist an office that is transitioning to a free-desk or flexible work policy. In both cases, employees may feel unsure about being able to find desks when they arrive at work. By utilizing a desk-booking tool during the transition, workers have the opportunity to get used to changing desks daily. This period also gives the company a chance to demonstrate that there will be enough workspaces provided to fulfill the office’s needs. If you’re looking to accurately track space utilization, if you’re a CREM wanting to bring data to the table so you can have eye-level conversations with management while removing emotion from big real estate decisions, or if you’re trying to find a software that can help you manage the ever changing workplace: you may want to consider an option beyond a desk-booking tool. Desk-booking tools are not an accurate indicator of people actually in the office at a given moment. As you see now, the system can often be misused by employees. A company looking for straightforward numbers to make large decisions like office expansions, consolidations and renovations, will not be able to get them from a desk-booking system. A desk-booking application could be the answer to your needs, but many companies might find more appropriate solutions to their problems using different technology. A desk-booking application could be the answer to your needs, depending on what problem you’re looking to tackle. In the short term, it can provide a sense of safety for employees and a level of reassurance for CREMs. However, desk-booking systems aren’t good indicators of actual office utilization. In this case, companies may find a more appropriate solution by using a different technology. So the question is: what do you need a desk-booking tool for? To learn more about how the workplace is transforming and what tools you can use to help with the changes, watch Locatee’s joint webinar with proptech research experts Memoori here! Information such as cost per square foot and density have always been at the forefront of driving corporate real estate strategy. In recent years, however, topics like employee satisfaction and company productivity have also emerged as important metrics for determining the overall performance of the office space. As work becomes more fluid and flexible, the analysis of where, when, and how work is being done all bear strong implications on the health and operations of an office space. This shift towards metrics focused on individual employee wellbeing and satisfaction—or human-centric metrics—has shifted attention to a revised set of real estate needs and KPIs. Right now, in the midst of the COVID-19 pandemic, corporate real estate managers need to measure and track performance metrics focused on enhanced occupant safety. But looking to the coming years, the permanence of human-centric KPIs is becoming ever clearer. The true value of corporate real estate space, after all, lies in its opportunity to support human capital. The advent of IoT technologies has led to improved data capturing and reporting, enabling corporate real estate managers to identify new trends and developments in the usage of their buildings. Coupled with the shift in knowledge workers’ behaviors, this is leading to an increased focus on the topic of occupant experience. Based on research conducted together with Memoori, Locatee predicts that companies that adopt technology-enabled workspaces which allow occupants to personalize and control their environment will have the largest competitive advantage in attracting talent and increasing productivity. Below are the new human-centric metrics (denoted in pink) which will further tech adoption and drive CREM digital transformation. Curious to find out more about each metric, its use cases, and the digital tools to help? Then download the full Workplace Leader’s Handbook of the Digital Tool of Tomorrow!What exactly is desk booking anyway?

Will desk booking exacerbate an already existing problem?

Will your employees support the use of a desk-booking tool?

Do you believe that users will comply with your desk-booking rules?

Are you trying to encourage collaboration and interdepartmental interaction?

Are you considering desk booking as a short-term compliance solution during COVID-19?

Are you considering desk booking as a long-term solution to measure office occupancy?

In summary

Get the „Workplace Leader’s Handbook of the Digital Tools of Tomorrow“

The transition to human-centric workplaces

The new metrics for corporate real estate management

The new human-centric performance metrics for CREM

The objectives and responsibilities of corporate real estate management are expanding, in no small part due to the developments of 2020. To address the evolving needs of corporate real estate management, we’re introducing a slew of exciting updates to Locatee. Here’s what’s new!

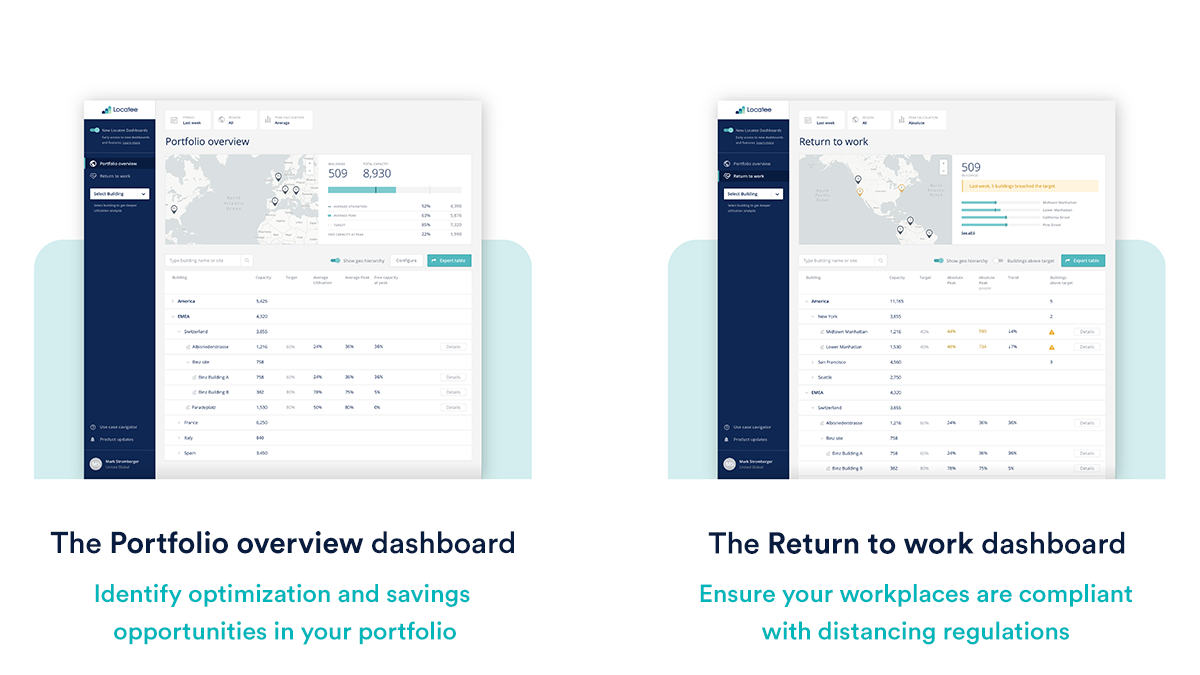

Separate dashboards to monitor safety and performance

Locatee’s latest update is the result of months of research, development, and testing in collaboration with current customers. During this time, we learned that although workplace leaders are still focused on optimizing their portfolio and assets, many have taken on the additional responsibility of ensuring that their workplace setups can react adeptly to fast-changing government guidelines when it comes to social distancing and office density.

Thus, one of the first differences you’ll notice upon signing in to Locatee is that you can now switch between two main dashboards: one for general performance, and another for safety monitoring.

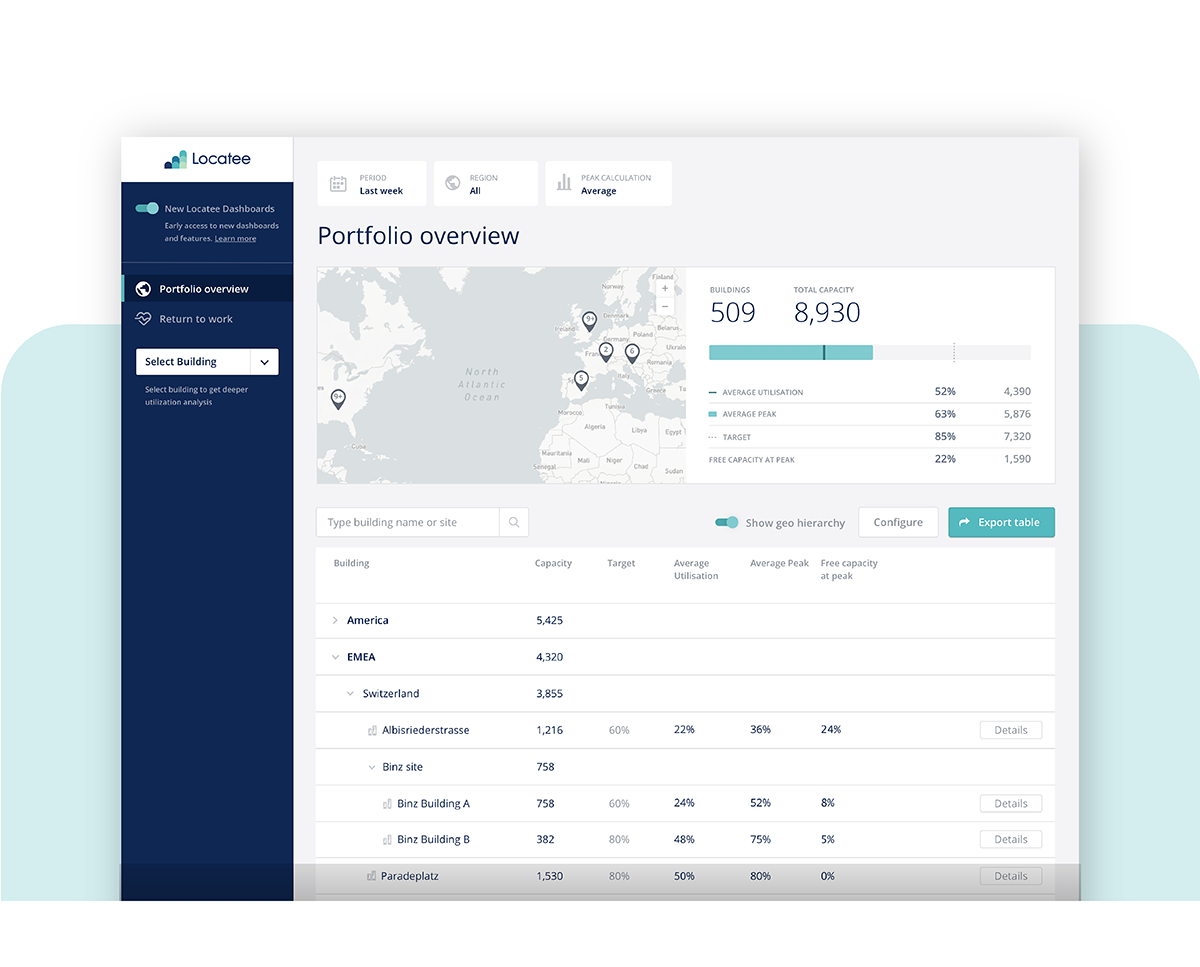

The Portfolio overview helps you stay informed and make better CRE decisions

We refreshed the main dashboard that you’re already familiar with from the classic Portfolio dashboard. Here’s a closer look at what you’ll find in the new Portfolio overview dashboard.

- Configurable metrics. Customize which KPIs and measurements you would like to see in your dashboard and hide the ones you don’t need to monitor.

- Export feature. Easily keep all your stakeholders informed and export your reports to an Excel file.

- More options to organize your data. You can now toggle between displaying the geographical hierarchy of your portfolio and hiding it for when you don’t need the information.

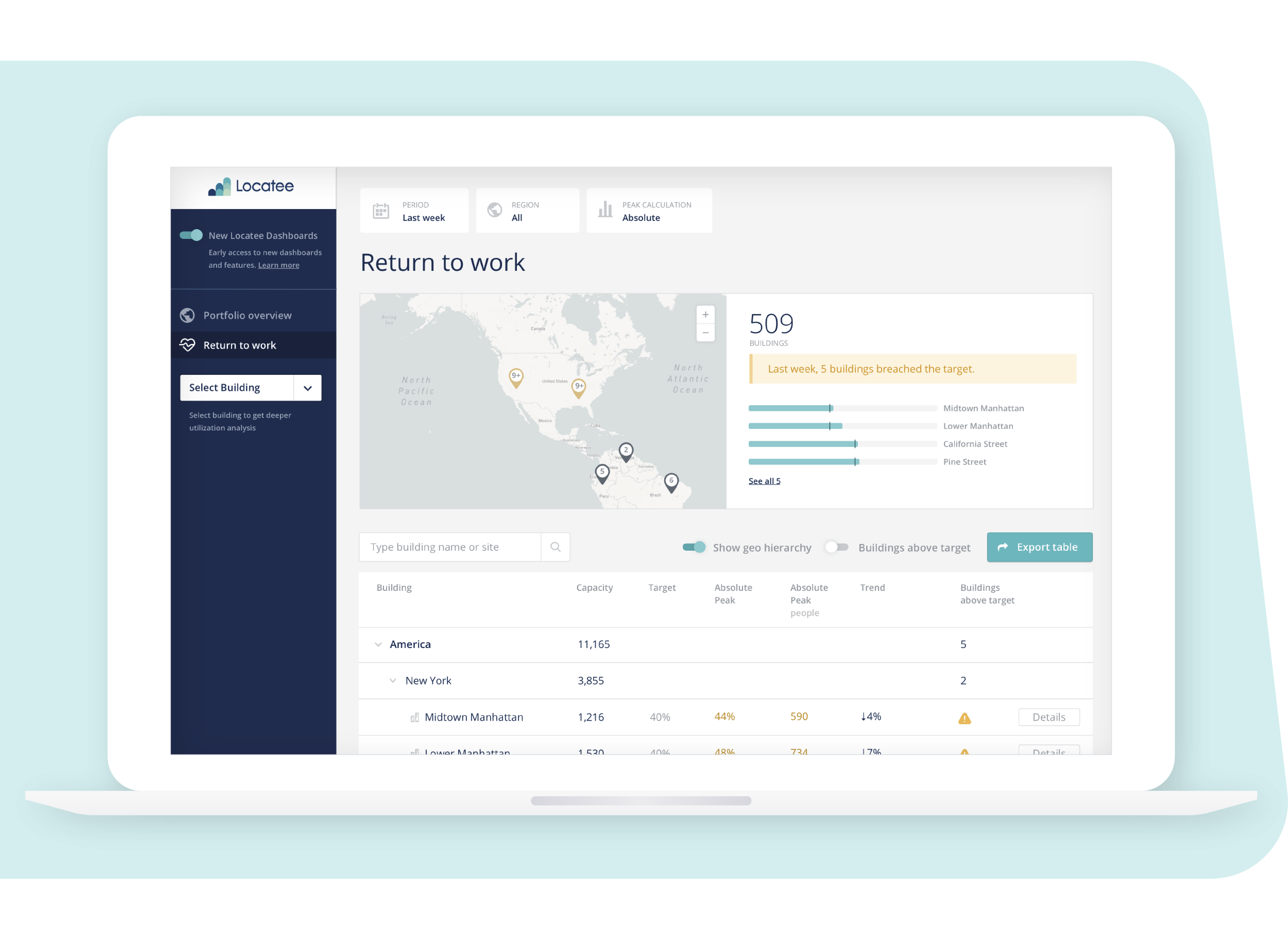

The Return to work dashboard helps you monitor safety compliance

Ensuring employee safety and complying with legal health guidelines have been two topics at the helm of 2020. To tackle the most pressing COVID-19-related obstacles facing corporate real estate managers—safety, compliance, and operations—the Return to work dashboard is now a permanent fixture in Locatee.

The Return to work dashboard lets you:

- Monitor safety targets. Track the custom safety occupancy targets you’ve set for the buildings in your portfolio.

- See occupancy alerts. Color markers signify if a site is operating above its target.

- Focus solely on buildings in need of attention. See at a glance only the buildings operating above their target safety occupancy.

And just like in the Portfolio overview dashboard, you can hide the geographical hierarchy and export your data for further stakeholder reporting.

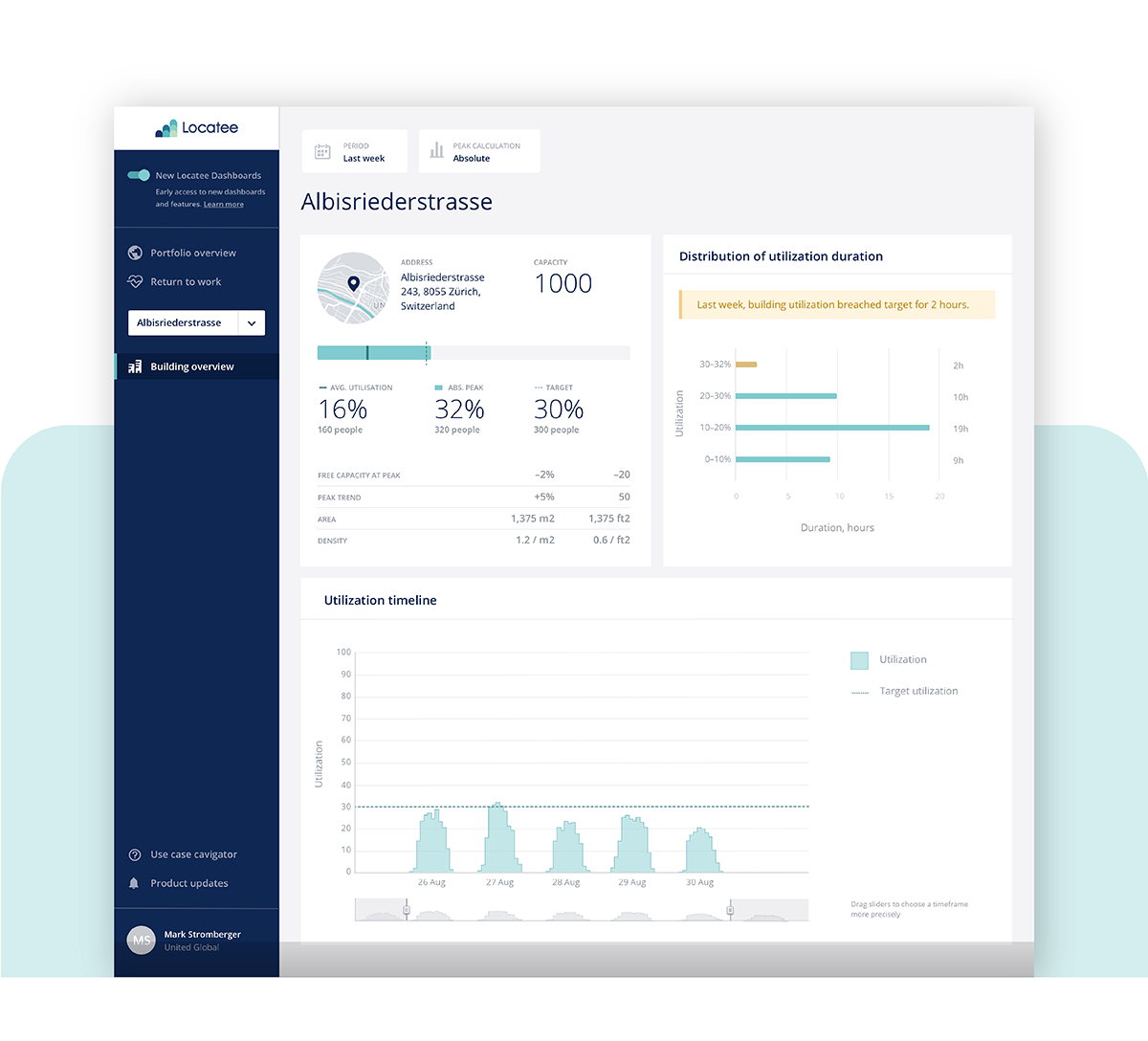

Peek into individual buildings for a closer analysis

The Building view is an all-new feature that we’re bringing to Locatee. Whenever you want a detailed look at the utilization of a building in your portfolio, click on a building’s name to pull up more information about its usage. Here’s what you can do in when you zoom into the Building view:

- Monitor an individual site’s performance. View any building’s vital stats such as capacity, the occupancy target set for that building, and the building’s peak utilization.

- Assess the severity of overcrowding. The Duration of office utilization widget reveals how long your office building has spent at a particular state of occupancy.

- Compare actual office usage with its intended usage. A utilization timeline shows the spread of your building’s usage over time against the occupancy target set for that building.

Are you ready to try the new Locatee Portfolio Insights?

Whether your focus is to spot savings potential, plan for growth, or keep your offices compliant and your workers safe, Locatee is here to help you make your most critical workplace decisions and take the risk out of planning your corporate real estate portfolio strategy.

Speak to a member of the Locateam to learn more about setting up the new Portfolio Insights for your organization today.

About the event

Gain insight into 2021 survey results on the evolving workspace and the role of CRE managers in the coming years!

Together with Verdantix, Locatee conducted interviews among 50 executives in real estate, workplace, and facilities management roles in the US.

Our Thought Leadership and Research Manager Sabine Ehm is joined by Dayann Charles, Industry Analyst at Verdantix to present the study findings.

Find out about:

- evolution of the CRE manager’s role in the US in the future

- increased influence of CREMs in their budget responsibilities

- business priorities today and in the coming years

- investment plans in digital tools and data collection

Speakers

Sabine Ehm – Thought Leader, Locatee

Dayan Charles – Industry Analyst, Verdantix

When

Date: Tuesday, March 9, 2021

Time: 12:00 EST | 18:00 CET

Registration

No time to attend?

Download the PDF

About

Corporate Real Estate needs to develop new performance measures for office spaces. Looking only at density or cost per square meter is not enough to understand and determine today’s workplace needs.

In this joint webinar together with Cognitive Corp. we dived deeper into the topic of the future workplace and discussed topics such as:

- The workplace of tomorrow

- Workplace Leaders roles and how to enable future workplaces

- Success factors for Corporate Real Estate Managers

- Tools workplace leaders should familiarize themselves with

The webinar took place on the 9. December 2020, 5.00-6.00pm (CET) during which we answered your questions online. Watch the recorded video below!

Speakers

Sabine Ehm – Thought Leader, Locatee

James Waddell – Executive Vice President, Cognitive Services

The management of the physical office space has become a business-critical topic for organisations around the world. While this may be of good news for you as a corporate real estate professional, there are still many hurdles and struggles to face:

- Do you feel enabled to contribute to your organisation proactively or strategically?

- Do you know the industry market and how to make use of the ongoing trends?

- Do you have the appropriate information or the tools to do your job successfully?

If you’ve answered “no” to one or several of the above, fret not: we translated those questions into a 3-dimensional model that reflects the challenges but also the opportunities of corporate real estate. The model reveals different approaches on how to master the challenges of corporate real estate in 2020. Armed with this knowledge, you will have all the makings to become a proactive leader and influential strategist in your company.

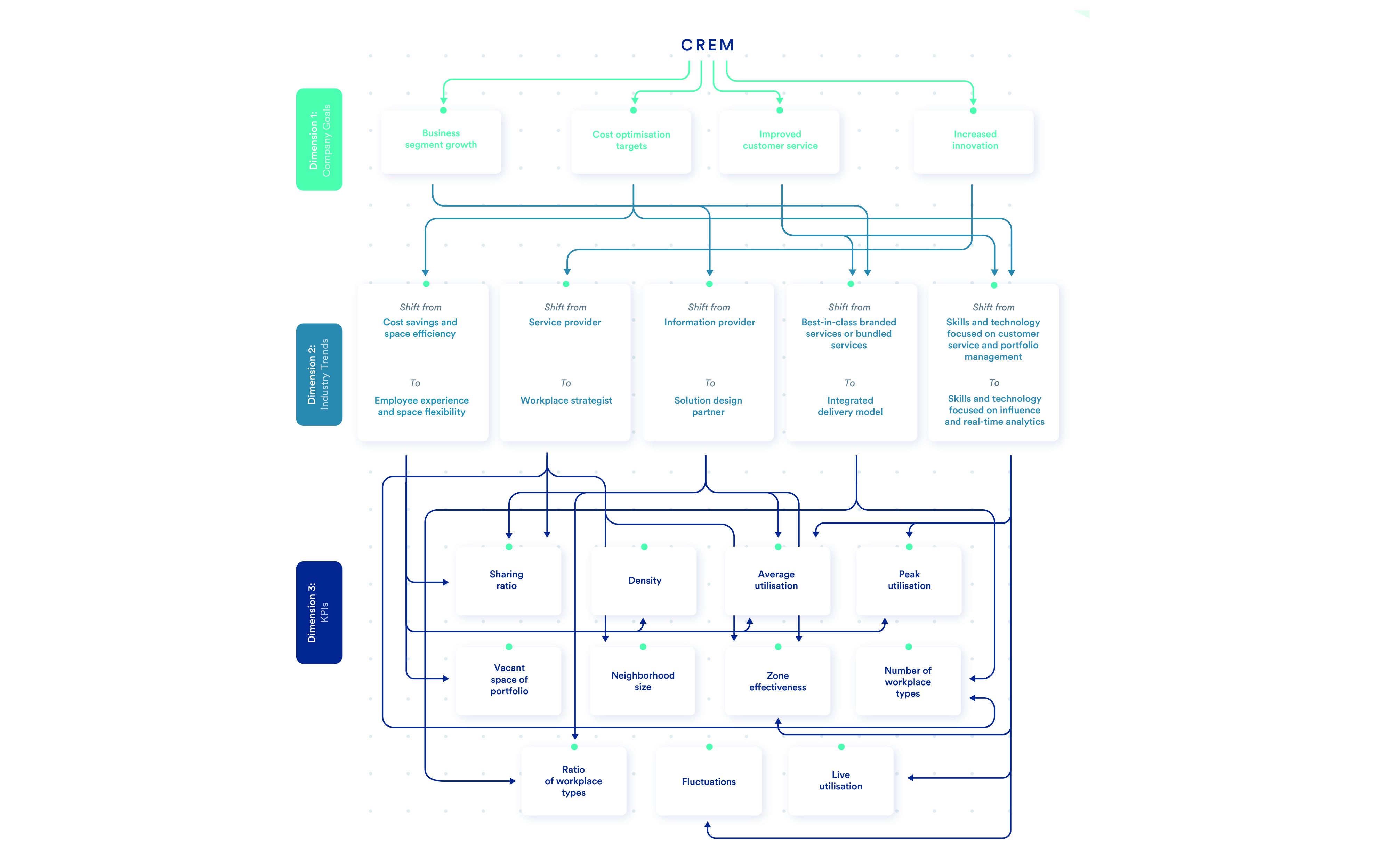

The 3 dimensions

Let’s have a brief look at the three dimensions and how they can be used to make your daily work more effective, sustainable and eventually more powerful.

Dimension 1: Corporate Goals

By keeping your objectives in line with those of your C-level executive team, you take active ownership in executing one common vision. Seeing their challenges as your own allows you to not only empathise, but also to get others onboard with your ideas and build up trust.

Are you aware of your corporate goals?

Dimension 2: Industry Trends

Knowing what lies beyond your company’s borders is crucial if you aim to position yourself as an expert. Stay afloat of actual trends and topics, and dare to engage in conversations with peers and competitors.

Are you on top of your industry trends?

Dimension 3: KPIs

Tapping into the power of data means more than collecting all the numbers, metrics, analytics and insights you can: it’s about having the right data in place. Thoughtfully determine which business results matter most first, and select and report on KPIs accordingly.

Do you have access to insightful workplace analytics data?

Do you want to read more about the 3 dimensions and how you can make use of them? Learn more!

Find your roadmap for a powerful long-term CRE strategy

Being aware of those three dimensions is helpful to understand single parts of the whole – by combining and aligning them, you will get a strong tool at hand to find your specific way for a reliable and actionable CRE plan tailored to your particular needs and circumstances. Thus, we created a roadmap covering all three pillars with different variables for each dimension, showing you different options you can choose from to establish your long-term corporate real estate strategy.

Download the map as PDF

Do you want to dive deeper into the 3 dimensions or learn more about certain scenarios?

We compiled a strategic guide for corporate real estate professionals who recognise their potential and wish to improve their standing within their company and on the industry market. It aims to help understand different aspects to consider, measures to take, and provides specific proposals on how to master the challenges which can be expected on the path towards the future of work.

You’ll find:

- The detailed 3-dimensional model explaining how company goals, industry trends and KPIs can influence your action plan and long term strategy

- 2 scenarios which will exemplify possible strategies on your way to becoming an influential strategist mastering the future of work

Do you want to learn more?

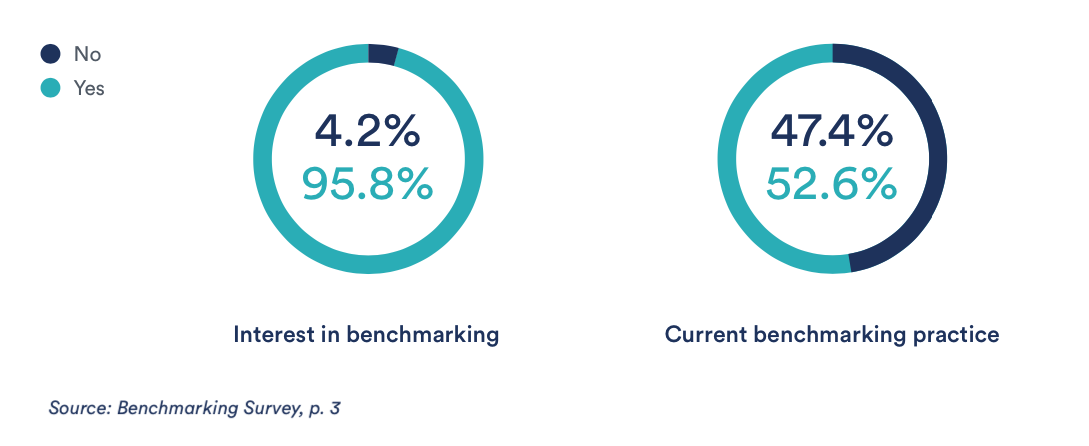

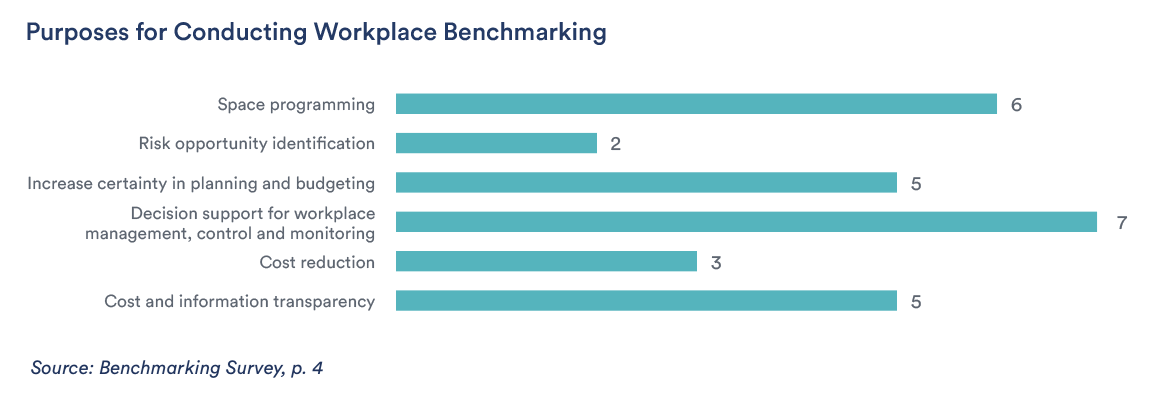

In times of COVID-19, successfully managing the office space and enabling employee mobility have become a business critical need. Benchmarking practices that monitor key metrics of different areas ease the required surveillance of office space – but not only in exceptional times.

The Institute of Facility Management (IFM) at ZHAW Zurich University of Applied Sciences and Locatee have joined forces to develop a benchmarking framework aimed at providing guidance on using space utilisation data for internal and external benchmarking. Therefore, they conducted a survey, asking CRE stakeholders about the value of different benchmarking areas and performance metrics.

Are you interested in the outcome of the survey?

According to the results, the main interests lie especially in space utilisation and density. But not as one might expect, these areas are less of an interest for cost reduction purposes but serve as support when it comes to workplace decisions. “The tendency for performance management and benchmarking is to become a core component of workplace management and an important activity to accompany organisations in the strategic management and development of their workplaces.” (Benchmarking Survey, p. 5)

Multiple studies have shown the importance of employee experience, such as CBRE’s Workplace Survey Research Report about the influence of workplace experience on employee engagement. This trend turned out to have an incremental impact also on benchmarking interests: survey participants stated to expect that areas such as the quality of workspaces will gain remarkable attention and demand for more user-centric metrics at the same time.

For more information about user-centric use cases, consult the Use Case Guide about how to navigate the complex smart building landscape!

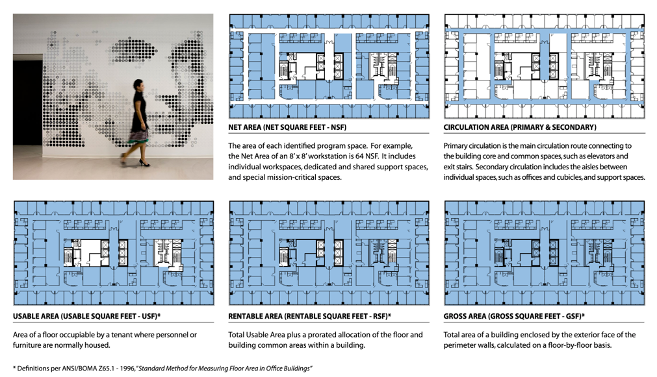

When it comes to the subject of taking up space these days, most of the attention is placed on the occupier, with the space being taken up often relegated to an afterthought. However, in the world of corporate real estate and workplace management, a small misaligned understanding of what “net area” means could potentially lead to catastrophic consequences and costs.

“Great things happen when the world agrees.” —International Organization for Standardization

What are standardisation organisations?

As globalisation connects people, businesses, and cities around the world, one of the challenges of international business is laying a common groundwork for understanding. Beside the International Organisation for Standardization, or ISO, there are several other organisations that publish guidelines on valuation standards. Some, like European Standards (EN) and The European Group of Valuers’ Associations (TEGOVA), publish standards adopted and approved for use across an economic region such as the European Union. Others, such as the Deutsches Institut für Normung (DIN) and the Asociación Española de Oficinas (AEO), operate with the specific aim of promoting and defining activity in country-specific markets like Germany and Spain.

Although their main aim is to eliminate barriers to business and trade, the different schools of standardisation which exist occasionally confound more than they enlighten. There probably is no better example of this in corporate real estate than the definition of “net area”: depending on which school of standardisation is employed, the same term can be taken to mean two very different concepts.

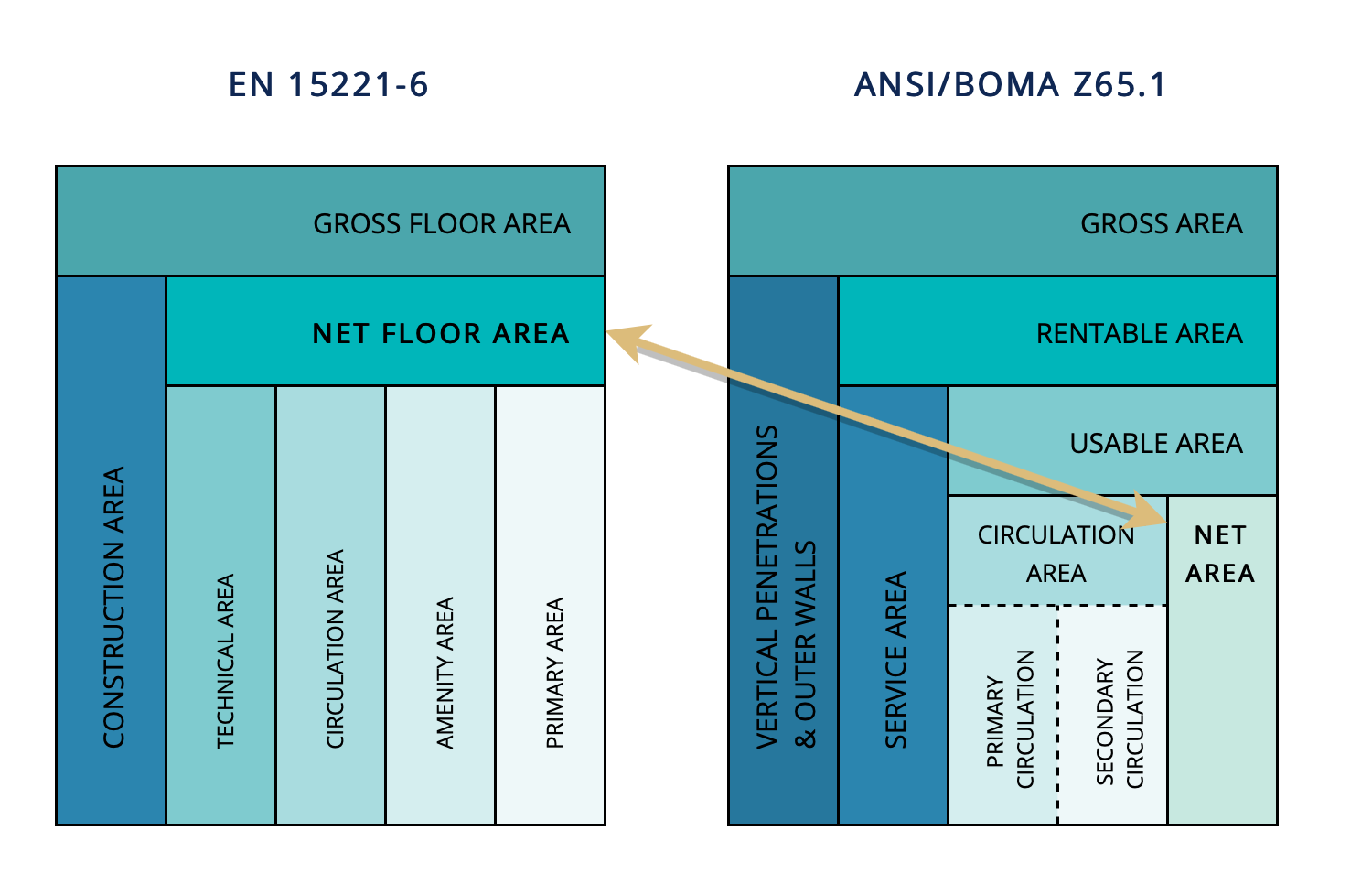

The difference between EN and BOMA standards

Since April 2012, the usage of the European Standard EN 15221-6 has been mandatory in the European Union. Across the pond, the Building Owners and Managers Association, BOMA for short, is a federation of US associations and global affiliates that have established a standard together with the American National Standards Institute (ANSI) to maintain floor measurement standards for property types such as office spaces. As the leading association for corporate real estate professionals in the US, BOMA is employed by many organisations based or headquartered in the US.

The European Standard: EN 15221-6

The European Standard uses the following terms to measure office space:

- Gross floor area: The total area of a building, calculated on a floor-by-floor basis, enclosed by the outer building’s outer walls.

- Net floor area: Commonly also referred to as “net area”, the net floor area is derived when the construction area, or the outer walls of a building, is deducted from the gross floor area. The space contained within the net floor area falls into one of four categories:

- Technical area: These are the technical rooms, air shafts, and server rooms of a building.

- Circulation area: In layman’s terms, these are the walkways on an office floor.

- Amenity area: Amenity areas includes toilets and kitchens used by the tenants or occupants.

- Primary Area: Finally, this is the main usable area which serves to fulfill the purpose for which the building is rented.

The American standard: ANSI/BOMA Z65.1

BOMA standards for office space employ the following definitions:

- Gross area: The total area of a building, calculated on a floor-by-floor basis, enclosed by the outer building’s outer walls. (This is more or less the same definition as outlined by the European Standard.)

- Rentable area: The rentable area is derived when all the building’s common areas such as elevator shafts and staircases are deducted from the gross area. This is the area a landlord typically rents out to a tenant, hence its name.

- Usable area: The usable area is derived when all the spaces that serve every tenant in the building such as lobbies and toilets are deducted from the rentable area. (Although occasionally, sharing the kitchen and toilet facilities with other tenants can make things slightly more complicated, as the rented space cannot be measured directly using the floorplan. In these scenarios, a common area factor is typically applied.)

- Circulation area: The ANSI/BOMA standards make a point to further categorise circulation areas into either primary or secondary circulation areas. Primary circulation would be the paths from the entrance door to the kitchen area, desks, elevators, and toilets. Secondary circulation would be the paths from desk to desk.

- Net area: Finally, the net area is derived when the primary and secondary circulation areas are deducted from the usable area.

EN vs BOMA space definitions

Herein lies where the main confusion comes from when it comes to talking about corporate real estate in an international context. While the European Standard definition of “net area” includes circulation area or walkways, by most American standards, “net area” does not. Thus, when two workplace managers look at the same building, how they define and measure space depends entirely on the standards they use.

EN 15221-6 vs ANSI/BOMA Z65.1

- EN (European Standard) defines net area as including circulation area, or walkways.

- BOMA does not count circulation area in net area. Instead, circulation and net area together form the usable area.

- The EN definition of net area is roughly comparable to BOMA’s definition of rentable area, as both exclude the outer walls or construction area of a building. However, there are still small differences between the two: BOMA also excludes vertical penetrations, or elevator shafts from the rentable area.

- The BOMA definition of net area is much closer to EN’s definition of primary area.

So should an organisation use EN 15221-6 or ANSI/BOMA Z65.1?

What adds to the confusion is that even within the same organisation, different offices may employ different measurement standards. A satellite office in Germany, for example, may calculate their floor spaces using EN or the national German standard DIN, whilst the organisation’s headquarters may use ANSI/BOMA. A lexical slip-up when talking about “net area” can mean a misunderstanding of hundreds of thousands of square feet—or metres! Imagine what that could mean in costs when misunderstanding the terms of a lease.

When it comes to talking about net area, circulation area, or any other spaces, there’s no standard which is better than the other. The most important thing to keep in mind is to always clarify terminology and measurement standards upfront.

Whether your organisation uses ANSI/BOMA or the European Standard, Locatee helps you measure your space occupancy. Take a look at how to measure and monitor your entire portfolio’s health with the Locatee Portfolio Insights:

Fragen? Kontaktieren Sie uns!

Locatee at the event

As a silver-level sponsor of the event, we participated in a panel debate for both North America and UK/EMEA.

Panel discussion

This top-class and well-known panel of CRE professionals discussed together various topics surrounding the workplace and explored the return-to-office-strategies not only providing a safe and secure environment but also enhancing the workplace experience for an evolving workforce.

Panelists (both events):

- Philip Ross Futurologist & CEO, Cordless Group & UNWORK

- Sabine Ehm Customer Success and Thought-Leadership Manager, Locatee

- Peter Otto Chief Product Officer, Condeco

- Mathias Elmiger Director, Knowledge and Data Strategy, Johnson & Johnson

- Peter Baumann, Global Real Estate & Facilities (GRF) Global Head of Projects, SAP

- Dr. Susanne Hügel, Director Head of Digital Innovation & Business Acceleration Continental Europe, CBRE

The panelists talked about the tools needed by the heads of Corporate Real Estate to successfully transition to new models of working in the post-pandemic world. From where people are sitting, to air quality and cleaning regimes, to new technologies for the workplace which can deliver an array of data and transform the user experience.

The virtual panel discussions took place on 14. October (North America) and 27. October (UK/EMEA).

Key takeaways from our panel discussions

-

- Health & safety of the employees as well as deploying according to smart tools remains the focus for corporations. Workplace strategists and CRE managers however are starting to look beyond.

- After a head start into the digital workplace and tools that enable remote work with the ability to fail and learn, employees and companies understand advantages and disadvantages of home work settings.

- The future will hold more choice for employees in terms of flex-time, flex-location and flex-workspace. Mindful choices to ensure productivity are being encouraged, but more importantly well-being and collaboration.

- Corporate Real Estate will be enhanced to reflect a more human-centric approach incorporating workforce aspects such as talent attraction, and a sense of community and belonging.

Video North America participation

Prepare yourself for the future of CRE

In collaboration with smart building research and thought leader Memoori we put together a handbook for CRE professionals. This handbook provides you with tips and the guidance you need to tackle the disruptive and volatile world of Corporate Real Estate.

Here’s a glimpse of some of the chapters you can expect:

- Digital Transformation in Corporate Real Estate

- Changing Roles and responsibilities of the CREM

- The Importance of Metrics

- Mapping of Metrics against Software Tools

- The Role of Software in CRE Management

„The Workplace Leader’s Handbook of the Digital Tools of Tomorrow“

Join the free webinar

Locatee Portfolio Insights ist eine kosteneffiziente Lösung, die Ihre Mitarbeiter wieder an den Arbeitsplatz zurückbringt, indem sie wichtige Daten zur Bürobelegung anzeigt. Da keine Hardware oder Installation vor Ort erforderlich ist, kann Portfolio Insights sicher eingerichtet werden und ist zudem skalierbar.

Bringen Sie Ihre COVID-19-Situation unter Kontrolle:

- Überwachen Sie die Gesundheit Ihres gesamten Immobilien-Portfolios

- Passen Sie Belegungsziele an

- Halten Sie alle Stakeholder stets auf dem Laufenden mit exportierbaren Berichten

Das Beste an Locatee?

Es funktioniert bereits mit Ihrer bestehenden IT-Infrastruktur. Keine kostspielige Hardware wird benötigt.

Haben wir Ihr Interesse geweckt?

Transcript

Mehr als je zuvor, müssen Führungskräfte im Corporate Real Estate verstehen, wie ihre Büroräume genutzt werden, um eine sichere und erfolgreiche Rückkehr ihrer Mitarbeiter ins Büro zu garantieren.

In einer zunehmend volatilen Arbeitswelt liefert Locatee Portfolio Insights die entscheidenden Daten und Analysen, um Unsicherheiten Ihres Unternehmens bezüglich Sicherheit, Compliance und Betrieb zu bewältigen.

Mit Locatee können Sie den Gesundheitszustand Ihres gesamten Immobilienportfolios überwachen, COVID-19-spezifische Belegungsziele festlegen und alle Stakeholders jederzeit und überall auf dem Laufenden halten.

Sehen Sie hier, wie Sie Portfolio Insights nutzen können um die Rückkehr Ihrer Mitarbeiter ins Büro zu planen.

Mit „Portfolio Insights“ behalten Sie den Überblick über den Gesundheitszustand Ihres gesamten Portfolios. Filtern und betrachten Sie die Bürobelegung und -nutzung nach Region, Land, Stadt oder Gebäude. Sie können sofort sehen, welche Gebäude überbelastet sind, oder wo Distanzierungsregeln nicht eingehalten werden.

Mit Portfolio Insights können Sie auch benutzerdefinierte Belegungsziele festlegen.

Sie können leicht benutzerdefinierte Belegungsziele für jedes Gebäude in Ihrem Portfolio erstellen und anpassen. Auf diese Weise können Sie sicherstellen, dass Ihre Back-to-Work-Strategie mit den Gegebenheiten Ihrer lokalen Büros in Einklang steht. Locatee informiert Sie, wenn ein Gebäude seinen sicherheitsangepassten Schwellenwert überschreitet, so dass Sie schnell reagieren können, und immer auf dem neuesten Stand bleiben.

Portfolio Insights verfügt über die Daten, die Ihnen dabei helfen, Belegungsmuster zu erkennen, Dichte-peaks zu untersuchen und die Gesundheit, Sicherheit und Compliance Ihres Unternehmens zu einer Priorität zu machen. Exportierbare Daten machen Briefings für Führungskräfte zu einem Kinderspiel, und ermöglichen Ihnen somit alle jederzeit und überall auf dem Laufdenden zu behalten.

Das Beste an Locatee ist, dass all dies bereits mit Ihrer bestehenden IT-Infrastruktur funktioniert. Die Einrichtung von Locatee Portfolio Insights ist sicher und einfach. Diese erfolgt per Fernzugriff für Ihr gesamtes Unternehmensimmobilien-Portfolio. Es sind keine Vor-Ort-Besuche oder Freigaben erforderlich, was Locatee zur skalierbarsten Lösung für die Messung der Arbeitsplatzbelegung macht. Weil Locatee die Daten über die LAN- und Wi-Fi-Netzwerke Ihrer Gebäude erfasst, kann auf den Kauf von zusätzlicher, teurer Hardware verzichtet werden. Da die Gewohnheiten und Verhaltensweisen am Arbeitsplatz immer flexibler und fluktuierender werden, zeigt Locatee langfristig Trends, Wachstum und Optimierungsmöglichkeiten auf und liefert Ihnen kontinuierliche Daten, damit Sie Ihre Arbeitsplatzstrategie an die sich ständig ändernde Arbeitswelt anpassen können.

Wenn Sie mehr über Locatee Portfolio Insights erfahren möchten, haben wir für Sie ein umfassendes Factsheet erstellt, das Sie direkt von dieser Seite herunterladen können. Wenn Sie mehr darüber erfahren möchten, wie Locatee Ihnen und Ihrer Organisation helfen kann, sprechen Sie noch heute mit einem Locatee-Experten über Portfolio Insights. Besten Dank für Ihre Aufmerksamkeit, und bleiben Sie sicher!