1: Will COVID-19 result in more or less office space in the future?

If we had to pick one, this would be THE question everyone involved in Corporate Real Estate Management would like to answer. There are many diverging opinions on the amount of office space needed post-COVID-19. Some are predicting full remote-work setups with a potential reduction of the office space down the line: Twitter, Morgan Stanley, and Salesforce count amongst the most prominent vocalists on this side of the spectrum. Others predict an expansion of the office space to comply with social distancing, with Ex-Google CEO Eric Schmidt and UBS real estate and lodging analyst Jonathan Woloshin as notable defendants.

>> Bring your workforce back into the office safely with Locatee <<

From the conversations we’ve had with our network, the overall consensus is that social distancing measures and policies will remain (at least, for a while), and with it, the need for more space surrounding each workstation. However, the changes in working patterns, including the offset effect stemming from more lenient work-from-home policies, will balance the demand for additional space.

With the prospect of an available vaccine within 18 to 24 months, it’s also more likely that companies will work with what they have asset-wise in the short-term and will neither add nor reduce a massive amount of space. Instead, the focus lies in developing strategies to maintain low space density and use existing and new technologies to optimise office occupancy across the building portfolio.

An additional factor which doesn’t speak in favour of a major increase in office space is the cost associated with it. At a time of economic downturn, companies cannot afford additional risks and most likely won’t sign long-term leases due to the unpredictable nature of the current situation. They will try everything possible to avoid taking on additional space at the moment.

Similarly, a major cut won’t happen overnight either. This is due to the inflexibility and often multi-year commitment of large space leases. In the near-term, companies are much more likely to keep their space but transform it with focus on attracting more talent, increasing productivity, or even turning some areas into co-working spaces (more on this later).

The effect on rent

Mass activity, whether increase or decrease, of the office space will no doubt leave noticeable effects on the price per square meter of spaces. As always, rent space will ultimately depend on many different market variables, but here are some scenarios of what to expect:

- The ratio of square meter to desk will be greater than before due to social distancing, which could lead to an overall increase in office space demand, ultimately driving the price of rent up, but…

- The ratio of square meter to employee ratio may go down as a result of more locational flexibility (ie. working from home), which could counterbalance the new supply-and-demand with little to no impact on overall if…

- The majority of people are able to keep their jobs. If not, then companies will seek to reduce their office space, bringing the price of rent down.

With all that said, it wouldn’t be surprising if in the long-term, corporations establish more satellite offices in more rural areas or downsize to smaller buildings, ultimately reducing the commute for its employees. However, this will take time and we’ll unlikely see large moves to decentralise within the next year or two. Overall, corporate real estate managers need to begin reconsidering the value proposition of having their offices located in city centres: why continue paying a high rent and expect employees to commute for hours every day now that the world has seen the capabilities of remote-work?

2: Beyond office space, what will the office of the future look like?

“I don’t believe home working translates to less space, it translates to different space.” Ken Raisbeck from CBRE on ITV News – May 5, 2020

Not more, not less, but different is probably what will happen. The office will transition from the workplace to a work point amongst a constellation of work points. Mobility and flexibility offered by companies to their employees will give an opportunity to each individual to decide where they want to work: it can be from home, it can be at the office, a coffee shop, a co-working space, or wherever else they feel the most productive.

In that new configuration, the office will have to reinvent itself to become a place where people love to work.

Even before the COVID-19 crisis, employees at small companies and large corporations worked with a relative amount of locational and temporal flexibility. This is why the estimated utilisation of a single desk was already below 50%. Simply put, it meant that half of all office buildings were empty at any given time. On paper, this would be a reason to optimise. But rather than “less”, most companies are going for “different” and higher quality. Why?

Employees need a place not only from where they can work; they also need a space to exchange creative ideas, collaborate and innovate. The evolution of the office from a place for focused activities into a place for teamwork and project work is taking hold. Think common spaces, meeting points, and technology-oriented rooms such as presentation studios or activity-based rooms featuring digital boards. Offices are becoming more playful and fulfilling more employee needs. Some parts even are beginning to look a bit more like Starbucks and less like a traditional office space. The reason for doing this is to increase the happiness—and ultimately productivity—of employees, but as well to attract and retain the best talent amongst younger generations like Millennials and Gen-Zers who have different expectations of their workspace than preceding generations.

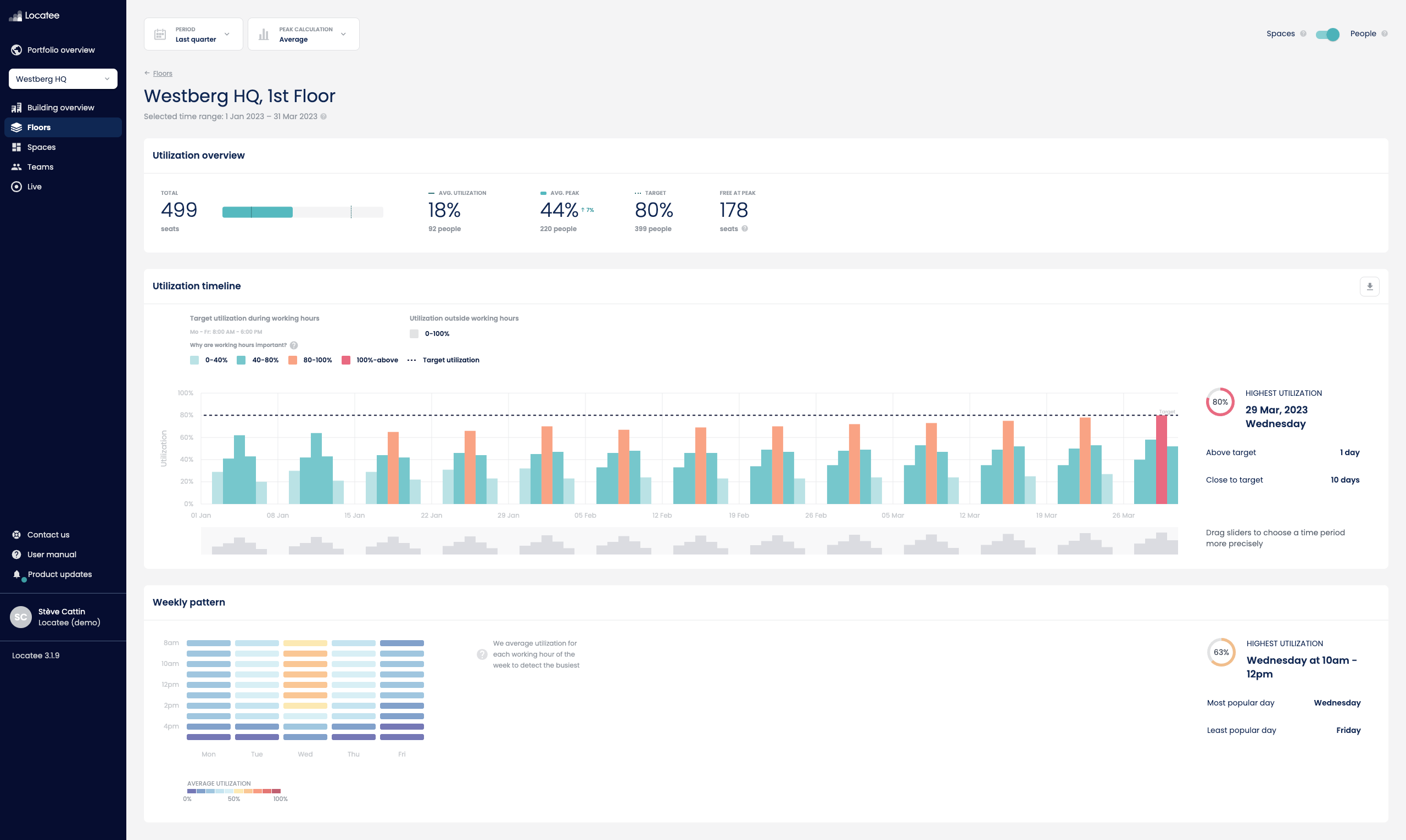

Down the line, we can expect work patterns in the office to be much more fluid, with fewer employees anchored to their desks. As such, data about office utilisation should support C-level executives and corporate real estate managers in making the right decisions on how to adapt their spaces to more activity-based work.

3: Has the office lost its importance in people’s lives now that everyone is used to working from home?

Firstly, let’s emphasise the fact that our current reality was actually not by choice, but by force (or the forces of nature). A recent article from Forbes recaps it well with the following quote.

“You are not working from home; you are at your home during a crisis trying to work.”

There’s another reason which makes us believe that the office is not going away any time soon: it is a cornerstone of community—a place to meet, socialise, and foster new ideas and discussions. On top of this community enabler role, the office helps build company culture and makes common values and missions more tangible.

If there’s one thing that 2020 has shown us, it’s that even though most people appreciate the opportunity to work from home, they crave interaction with other people. We’ve seen parties moving online, birthday celebrations did not stop, people have begun calling each other more, companies have started organising virtual coffees and after-work drinks, and so on. Humans are fundamentally social creatures technology is only but a temporary replacement for real-life encounters. The moment that governments begin to ease lockdowns, it is inevitable that people will rush outside to see their friends and families face-to-face. On top of the common values of a company, we’re really now seeing the strength of the bond that work colleagues create with one another. It really forms the social fabric of the team and the organisation; and this type of interaction is not as easy to create online as it is to create in-person. A survey of 1,100 employees in the United Kingdom by Tiger Recruitment has shown that even though 95% of employees see the benefits of work from home, 55% still miss social interactions with their colleagues.

To drive the point home that the workplace acts as a social enabler are coworking spaces. Why do people pay to be in a different workplace if they can work from home? Coworking spaces bring focus, bring atmosphere, and bring the opportunity to have exchanges with others, thereby fostering creativity and innovation. People not only enjoy the change in location, but want to be in a more office environment to do work.

A final reason why the general consensus is that offices will remain important is that it permits us to keep a stronger separation between work and private life. There have been many discussions in previous years about the blur of the work-life balance, and while it’s true that we can often be working at anytime and anyplace, offices provide an option for those who prefer to keep their private and professional lives in more distinct spheres.

4: Does the steady rise of locational flexibility mean the death of corporate real estate management?

As we know it, yes.

It will certainly mean the death of uninformed corporate real estate managers relying on old methodologies to “guesstimate” what happens to their building portfolio. Those who are not able to adapt and catch up with current trends will eventually flounder and fail. Think about the following points:

- COVID-19 has accelerated the move from the workplace as one anchored place to multiple work points: there is a rising tendency for people working more asynchronously as well as from anywhere. This all has profound impacts on calculating the among of space needed to be reserved per employee in the office.

- The office space has taken on an additional identity: we’re perceiving it now as a space to meet, create, and establish a sense of community and belonging.

- Expect post-pandemic repercussions such as social distancing guidance to stay for a while: new benchmarks that adhere with compliance rules and regulations will be set which will present new challenges.

- We’ll start to see the beginning of the economic slowdown put increased economic pressure for companies to organise one of their biggest cost centres: real estate.

The office certainly won’t go away, but it will change—becoming less about space and more about people. Parallel to that, the role of the corporate real estate manager will also morph into a workplace strategist profile, taking on three additional dimensions: industry trends, company goals, and data-supported KPIs. We may expect some functions traditionally performed by IT or HR to also be merged together.

“In 20 years, we might not see any differences between HR, IT, and corporate real estate management.”

These roles will focus on people enablement, and assets such as the physical workspace and IT tools will simply become resources they will be expected to manage. Whatever the title may be for these CREMs/workplace strategists of the future, they will need to measure, manage, and master their assets and data. This may sound like a daunting prospect, but with the right tools, it creates an incredible opportunity for them to take a seat at the C-level table.

The office won’t go away, and Corporate Real Estate Managers will morph into Workplace Strategists that juggle with three dimensions: Industry trends, company goals and, finally, data-supported KPIs. To survive, CREMs will have to measure, manage and master. It may be a daunting prospect, but with the right tools it actually creates the most incredible opportunity for them to gain a seat at the C-level table.

5: Can Corporate Real Estate Managers actively support the economic recovery of their companies?

Considering that real estate makes up the second largest expense after salaries in many service-oriented companies, there’s no doubt about that. The biggest obstacle facing corporate real estate managers right now is the limited transparency they have over their assets. Not having real-time office utilisation analytics is like flying in the fog. It results not only in difficulties in understanding what needs to be done, but also in baseless conversations due to the lack of sufficient data. With accurate, portfolio-wide insight about the office buildings and workplace analytics, decisions can be taken more objectively. Speaking from experience, we’ve seen our customers achieve some astounding economic objectives through the smart use of data, including:

- Saving 2.5 million Swiss francs per year by understanding space availability and optimising existing space instead of adding additional buildings to the CRE portfolio

- Consolidating 9 separate buildings into 1 central HQ

- Saving 300,000 euro per year just by reducing 10% of existing office space

These are just a few examples of how corporate real estate managers can support and improve the economic stance of their organisations. On top of that, smaller adjustments such as cleaning and HVAC optimisation can also make a noticeable difference in expenditures and savings. Taking all of the points into consideration, which ones do you think you can apply to your organisation and corporate real estate portfolio?

15’

15’