“Hey, I don’t want to be data-driven”

– said no one ever.

But to look beyond the obvious, is to be courageous.

No one in their right mind would risk looking completely out to date and incompetent by declaring themselves allergic to data in 2023. But when no one is looking, when there are no likes to collect on social media, when the self-aggrandizing topics hold no real value, the real questions come.

Where do I start?

What are the main categories for workplace data?

Let’s start by roughing out the whole landscape. When it comes to the most important metrics, workplace data is thankfully not too compley. However, it can get quite confusing if one doesn’t have the two main categories clear in their mind:

UTILIZATION VS. OCCUPANCY

For years, these two terms have been thrown around indiscriminately (we’ve been guilty of it too). However, they are referring to two very different notions.

Utilization is a “blind” measure of the number of people present in a specified space over a defined period of time.

Occupancy is the count of the distinct people who have been identified as using the defined space over the period of time specified.

It is important to note that neither of these metrics should be used as a sole source of truth when consolidating floors or buildings. Instead, all metrics should be considered in conjunction with company policies and desired utilization targets to make informed decisions. Additionally, combining the utilization and people count metrics provides a more comprehensive understanding of building usage patterns. For example, if the average utilization is 30% and the average people count is 75%, it indicates that there is a high turnover of employees, meaning that the total number of people entering the building is twice as high as the number of people present at any given time.

N.B.: Most methods of measurement of space will only be able to report on one or the other category, exclusively. Wi-Fi measurement is the only method that is able to combine both categories (with limitations for example in meeting rooms that can be mitigated by combining datasets).

PEOPLE BEHAVIOR METRICS

Utilization and occupancy are “snapshot” metrics. These are the metrics you start your workplace investigations with – “do we have enough space? What space types do we need?”

But most of the time, these metrics will leave you unsatisfied. They may give you an idea whether your current space supply is met by a corresponding demand or not; scratching beyond that surface-level analysis requires more context. This is where people behavior metrics help workplace leaders, by helping them get more depth to their understanding of that demand.

An example of this depth: utilization will tell you whether a space has been occupied at least once during the day. Occupancy will tell you how many distinct people have been using that space during the day. Finally, behavior metrics will tell you how much time a “session” in that space is lasting on average. A “session” is a term derived from website analytics that is a group of user interactions with your website that take place within a given time frame.

People behavior metrics allow you to get closer to that “session” concept, by informing on the user interactions with the space.

What metrics do we find in the “Utilization” category?

| Average Utilization | The average recorded utilization levels over a defined time period. |

| Absolute Peak | The maximum recorded utilization levels over a defined time period. |

| Weekly Utilization | Average Utilization (%) and Absolute Peak (%) metrics by the day of week. |

The utilization metrics measure the number of people present in a building, floor, or zone at different times throughout the day. These utilization levels are then aggregated over a given time period to provide an overall metric, the average and peak utilizations. These metrics are useful for understanding usage patterns in a hot desk office environment, where employees do not have dedicated workstations. When using these metrics for building consolidation, it is important to consider the peak utilization in addition to the average, as the peak utilization provides insight into the building’s ability to accommodate employees at all times.

What metrics do we find in the “Occupancy” category?

| Distinct People | The number of distinct people counted over a defined time period. E.g. daily distinct people count would correspond to the total number of people that visited the office on a specific day. |

| Average Daily Distinct People | Average value of daily distinct people counts over a defined time period. |

| Max Daily Distinct People | Maximum value of daily distinct people counts over a defined time period. |

The people count metric describes the building usage as a count of the distinct people who were measured in the workplace at least once during the day. This metric is useful for offices with workstations that are not interchanged between employees during the day. For consolidation use cases, the people count metrics can be used as a “safety net” to ensure that employees have access to an exclusive workstation.

What metrics do we find in the “People behavior” category?

| Attendance Frequency | The average number of days people came into the office per week. |

| Time Spent by Space Type | The percentage distribution of time spent in desks, meeting rooms, collaborative spaces and other types of spaces. |

| Time Spent | The average number of hours spent at the office over a defined time period. Constantly connected devices have been excluded in this metric. |

| Entry and Leave Time | Percentage distribution of entry and leave events by time (hour). |

The people behavior metrics offer insights into habits and work culture displayed by employees working at a specific office or a group of buildings. These metrics include information on time-related behavior such as popular times to enter and leave the office, average time spent as well as frequency of visits. In addition, a deep dive is offered into the predominant work settings, whether there is a preference towards working in individual spaces such as desks or in collaborative areas. The insights on people behavior can be useful in order to implement policies and introduce office setups that promote collaboration and teamwork as well as ensure overall employee satisfaction and well-being.

Contact us for more information

Discover the immense ROI potential of workplace analytics, a game-changing tool for organizations aiming to boost productivity, optimize resources, and improve employee well-being. In this article, we explore the benefits and return on investment (ROI) of workplace analytics.

Workplace analytics empowers data-driven decision-making, streamlining operations, and creating efficient spaces that resonate with employee preferences. By analyzing workplace data, organizations can optimize real estate costs, design productive environments, and foster collaboration. Beyond space optimization, workplace analytics positively impacts employee well-being and engagement.

Choosing the right tools is crucial for success in workplace analytics. Locatee, renowned in the field, offers purpose-built products to leverage analytics effectively. The accompanying table highlights Locatee products and capabilities for achieving desired benefits. However, other tools and solutions in the market can be considered and combined with our solutions based on individual requirements, priorities, and budgets.

Global & organizational-level benefits

CRE Data Maturity

Description

Unlocking savings and additional value in CRE requires data. The data maturity journey leads from availability, to accuracy, accessibility, to being actionable and predictive. Any CRE tech solution has to improve one or several elements of this journey to be valuable.

Stakeholders

Global and regional CRE managers, finance, facility management (FM), HR, data scientists, building engineers, architects / interior designers, C-level, employees

Locatee solution

Locatee Analytics + (Locatee Advisory Services)

Effort

Ongoing exchange in business calls or specific advisory workshops

ROI Opportunity

Significant quality increase of any use case mentioned below / any strategic and operational CRE decision taken

Enable a data-driven organization

Description

Enabling the entire organization to make data-driven decisions often takes a team that turns data into insights and prepares easy-to-share documents to disseminate the information.

Stakeholders

Global and regional CRE managers, finance, facility management, HR, data scientists, building engineers, architects / interior designers, C-level, employees

Locatee solution

Locatee Standard and/or Tailored Reports

Effort

Connection of existing data sources into Locatee

ROI Opportunity

Avoidance of costs related to building the company’s own team of data analyst

Global and regional building portfolio optimization

Description

Comprehensive overview over utilization across the whole building portfolio.

Stakeholders

Global and regional CRE managers, finance

Locatee solution

Locatee Portfolio Insights

Effort

Connection of existing data sources into Locatee

ROI Opportunity

Portfolio rightsizing saving potential is 300’000€/year for a 100-desk site (estimate based on a Locatee customer’s benchmark)

Mobility Patterns /1

User-driven office space

Description

Understanding people mobility patterns and their utilization preferences (eg. commute time v. days at the office),, leads CRE, Workplace and Facilities leaders to create workspaces that foster productivity and collaboration by meeting the needs of a diverse workforce.

Stakeholders

Global and regional CRE managers, finance, HR/Talent acquisition

Locatee solution

Locatee Team Analytics

Effort

Connection of existing data sources into Locatee

ROI Opportunity

By improving the home bases in their headquarters, a customer found potential to consolidate further buildings by adding 150 employees into their headquarters. A savings potential of 15–20% of the office space costs was achieved

Mobility Patterns / 2

Flexible scheduling

Description

As more businesses are adopting a Results-only Work Environment (ROWE) approach, understanding how to foster productivity - e.g. through a golden hours-based work prioritization - can disclose a significant ROI for the individual, the team and company.

Stakeholders

Regional and local CRE manager, FM, and HR/Talent acquisition teams

Locatee solution

Locatee Tailored Reports + data related to selected business units + machine learning (ML)-based occupancy forecasting

Effort

Identification and selection of relevant parameters (e.g., related to employee personas); ML modeling, training, testing, deployment and maintenance; Data analysis & Reporting

ROI Opportunity

For every Euro invested in ROWE work culture the company saves up to 1.40€ through improved work/balance, increased sense of ownership and staff retention.

Energy Savings

Description

Through reporting and the crossing of multiple data sources, potential energy saving opportunities (e.g. electricity, heating, cleaning) can be highlighted.

Stakeholders

Global and regional CRE managers, global and Regional FM managers, third-party providers, finance, ESG/Sustainability teams

Locatee solution

Locatee Custom Reports + data related to energy consumption

Effort

Connection of existing data sources into Locatee; Collection of disparate energy-related data; Data analysis & Reporting

ROI Opportunity

From Locatee customer’s benchmark: between 10 and 40% savings on energy consumption

Project Management

Description

The quality of the evaluation, implementation and maintenance over time of a tech solution is highly dependent on an effective, capable and thorough project management activity for all the key operational stakeholders involved at different stages in the process.

Stakeholders

IT compliance, in-house IT infrastructure management (at global, regional and onsite level) and/or external IT infrastructure services providers teams, inhouse BI and analytics teams, innovation and digital transformation champions. CRE managers, workplace experience, procurement, legal, workers council (if required)

Locatee solution

Comprehensive standardized project management, based on proven, multi-year expertise in global product testing and rollout of projects for multinational businesses

Effort

Project management setup prior to and at the start of testing and rollout phases, dedicated account management and technical project management team with all operational stakeholders engagement on both sides, ongoing, close meshed project management

ROI Opportunity

Efficient and in-depth solution evaluation, leading to the right investment decision, saving time and other resources in evaluation and rollout, preventing costly mistakes, increasing product experience and stakeholder satisfaction across the unit and the business

Regional, site or building-level benefits

Mobility Patterns / 3

Optimization of the office’s equipment and supplies

Description

Overbooking and no-shows are two major factors disrupting the employees’ experience when it comes to flexible working. Using booked vs actual occupancy analysis, it is possible to identify what factors, in relation to office equipment and supplies like e.g., projectors, whiteboards, fans or coffee machines, drive or deter space demand, allowing for a low-effort, micro optimization of office space.

Stakeholders

Regional and local CRE manager, FM and IT teams

Locatee solution

Locatee Custom Reports (Booking vs. Utilization match rate) + room booking data

Effort

Connection of existing data sources into Locatee, or integration with existing space booking systems (Ingress API) if needed.

Data analysis & Reporting

ROI Opportunity

Office equipment represents a powerful productivity enabler and a competitive advantage of the corporate office over WFH and achieving the right blend of onsite and remote working through micro-optimization can increase employees’ satisfaction by 5%

Optimization of space allocation within a site

Description

With the rise of flexible working, many organizations are introducing flexible workspace concepts where employees do not have their own (assigned) desk anymore. Instead companies provide unassigned space with a specific sharing ratio (e.g. 1.2 employee per desk). This use case helps to define how much workspace a "team" needs so it's both efficient & enjoyable, using a sharing ratio.

Stakeholders

Regional CRE managers, site managers, finance

Locatee solution

Locatee Workplace Operations

Effort

Connection of existing data sources into Locatee

Mapping of floors

ROI Opportunity

Insights on utilization and team mobility patterns enable Locatee’s customers to improve space efficiency by up to 30%, leading to significant cost savings on avoiding additional space.

Eg. on a 100-desk site, potential savings reaches up to 514K€

Rebalancing space types within a site

Description

Locatee supports customers in evaluating their need for additional non-bookable meeting rooms and phone booths.

Stakeholders

Regional CRE managers, site managers, finance

Locatee solution

Locatee Workplace Operations combined with sensors

Effort

Connection of existing data sources into Locatee

Mapping of floors

Purchase, setup and maintenance of sensors

ROI Opportunity

Customer example:

In a 7 floors building, it was discovered that the plan to equip each floor with one additional phone booth was not necessary and could be substituted with the optimization of existing space.

Considering the cost of installing additional phone booths, adding one booth per floor would have led to a minimum additional investment of 73,500€

FM Savings

Description

The use of data to adjust and customize Facility Management services can lead to substantial savings.

Stakeholders

Regional FM managers, third-party providers, finance teams

Locatee solution

Locatee Workplace Operations

Effort

Connection of existing data sources into Locatee

Mapping of floors

Data analysis & Reporting

ROI Opportunity

Through a ROI simulation realized for one of our customers, it’s been estimated that for a volume of 4000 SQMs optimized, 50k€ FM cost savings could be realized

Smart Cleaning

Description

Cleaning tours can be planned more efficiently using low-medium-high service levels based on actual occupancy and utilization, which minimize waste and disruptions.

Stakeholders

Regional FM managers, third-party providers, finance, ESG/Sustainability teams

Locatee solution

Locatee Workplace Operations + integration with cleaning provider

Effort

Connection of existing data sources into Locatee

Mapping of floors

Data analysis & Reporting or direct integration with third-party (through API)

ROI Opportunity

Customers reported up to 20% cost savings on cleaning services since using Locatee data for smart cleaning

Navigation (Signage)

Description

Increasingly flexible work setups necessitate up-to-date workplace information to navigate around the office and improve the employee experience. Employees want to find the right space easily.

Stakeholders

Employees

Locatee solution

Locatee Smart Signage

Effort

Connection of existing data sources into Locatee

Mapping of floors

ROI Opportunity

Over 30% of people working in a flexible office say they lose time trying to find a desk. Knowledge workers spend as much as 60 minutes per week looking for a suitable place to work. On an office population of 100 employees, that would translate in four full days of work regained

Technological investment benefits

Investment decisions into additional solutions

Description

Utilization data can be collected by adopting numerous, different solutions. The key is to understand which solutions serve which use cases and how to best connect them to avoid data silos, complexity and to maximize value.

Stakeholders

CRE managers, investment board, finance, IT

Locatee solution

Locatee acts as an independent advisor, who can suggest where an additional data source can lead to additional and valuable insights, and where not. To achieve that, Locatee relies on the knowledge coming from established partnerships with other solution providers (no financial incentives apply nor Locatee covers the supply of any other solution)

Effort

Ongoing exchange in business and tech calls or specific advisory workshops

ROI Opportunity

Preventing unnecessary investment. Significantly reducing average integration time, thanks to established integrations (or standardized discovery processes for a range of additional solutions)

Off the shelf integration & API

Description

To break data silos and obtain the insights required to pilot a CRE strategy, systems have to be interconnected (both ingress and egress).

Stakeholders

Global and regional CRE managers, HR, third-party providers

Locatee solution

Locatee Ingress and Analytics APIs

Locatee Integrations and Professional Services (optional)

Effort

Connection to other systems, integration of Locatee data into other systems, low effort for existing integrations to medium effort for new integrations through the API

ROI Opportunity

Leveraging office building data with custom applications leads to a specific ROI, based on the application

Use-driven granularity

Description

Highly granular information is expected for specific, mainly enclosed spaces, like meeting rooms or phone booths, while it often becomes unnecessary for collaboration/ hoteling areas. Furthermore, granularity comes at a price, as covering a high number of desks with sensors is usually impractical and costly.

Stakeholders

Global, regional CRE management, third-party providers and partners

Locatee solution

Locatee Ingress API

Locatee Standard and Custom Reports, when applicable

Effort

Connection to other systems. Low effort on API integrations for existing, tried and tested integrations. Medium effort for new integrations with the occupancy monitoring sensors’ providers cloud.

Data Analysis & Reporting

ROI Opportunity

Using our extensive integration partner network as well as a robust custom API, Locatee was able to leverage sensor providers’ data and achieve full coverage of space utilization insights for a global Pharma customer, while allowing for a lower than expected investment by the client.

The Locatee Analytics dashboard provides a single pane of glass, eliminating any friction, inaccuracy and waste of time related to switching between platforms.

A check-in on the global workplace occupancy trends, by Locatee.

Data source: anonymized Locatee customer data in the given time periods.

The return of the Office?

After the great panic of 2020 (will offices ever be used again?) and the great employee empowerment that followed, it seemed clear for all to see that we had entered the new era of Employee Experience.

An era in which the office would be profoundly questioned, critiqued, buried and re-born anew, following the vicissitudes of the new normal, of anywhere-work, of economic downturns and price inflations.

The greater promise, experts said, would be a search for purpose, for intent, enabled and maximized by the availability of technology, data and artificial intelligence. We would see the disruption of the decades-old “one-size-fits-all” office, ushering in the age of the tailored work experience.

As of today, that vision still probably holds. But as our guest Harry Morphakis from Accenture was indicating in a wonderfully great podcast episode recently, this transformation is still very much underway, and chances are, this promise will really start to bear fruits in the next 5 to 10 years.

Newest trends in occupancy data

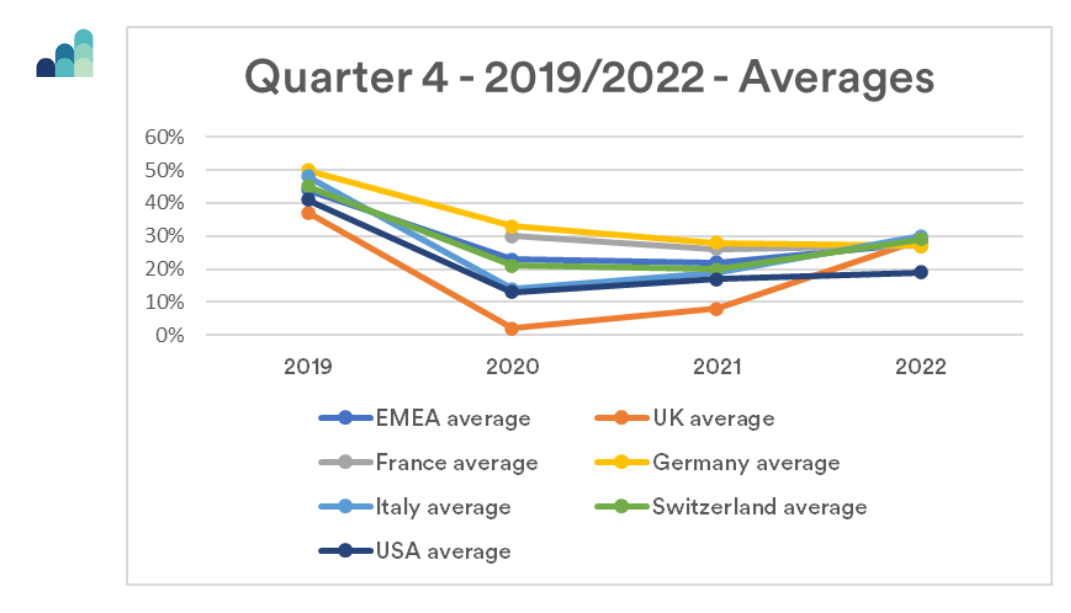

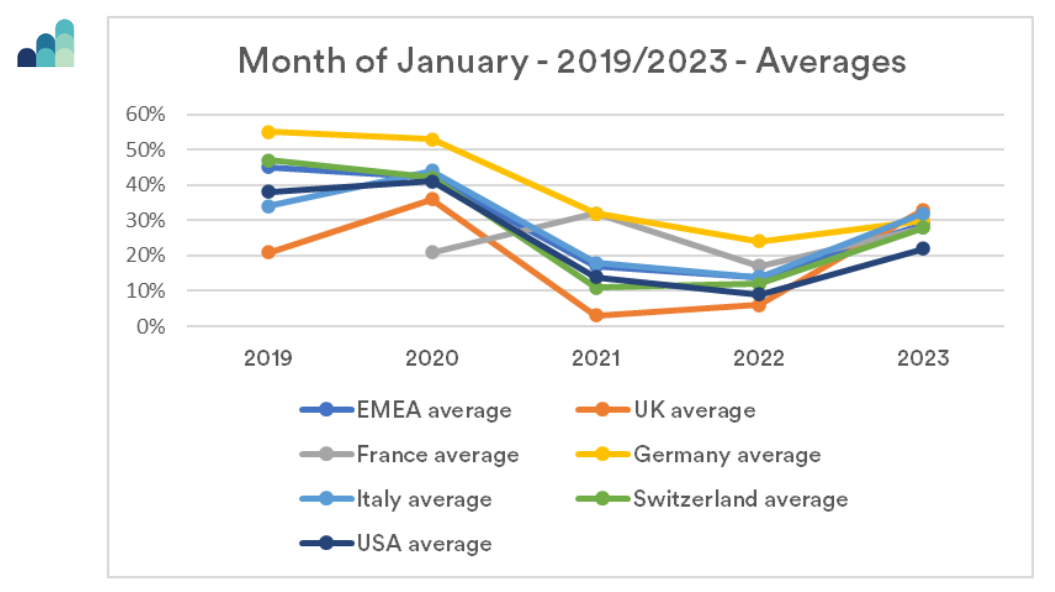

The first thing we notice when looking at the utilization metrics of Q4 2022 and January 2023, is that the very low rates we were witnessing throughout the pandemic are seemingly a thing of the past.

While the average utilization is still much lower than the pre-pandemic levels in each country observed, this average is stabilizing somewhere between 20% and 30% – rates that are 10 to 20 percentage points lower than pre-pandemic, but also 5 to 20 percentage points higher than during the 2020/2021 COVID-era.

This evidently looks like a stabilization of the hybrid patterns for the office. We can officially say the new normal has arrived, and is here to stay.

Getting people together

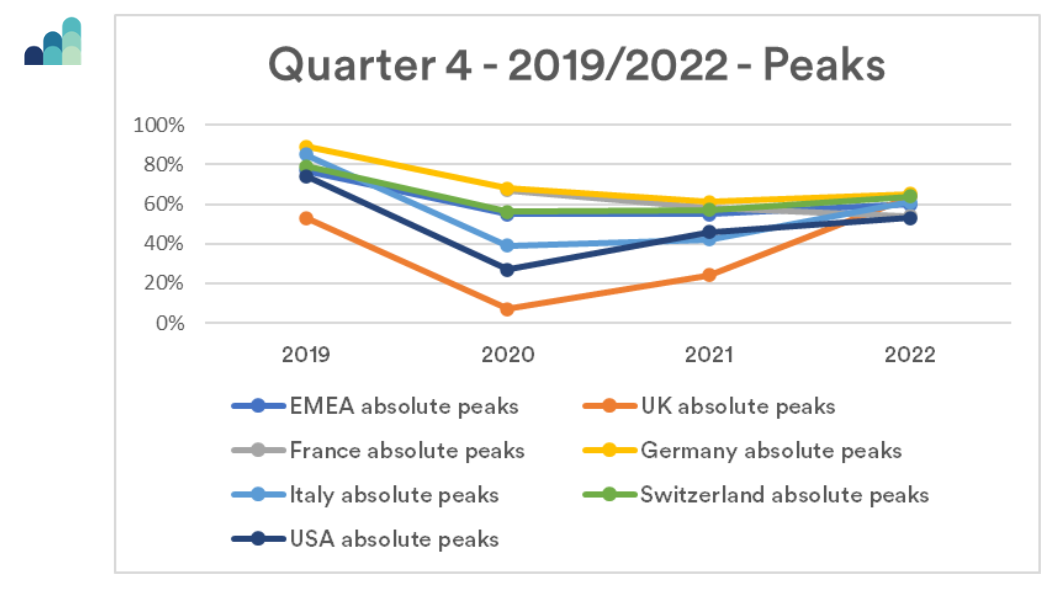

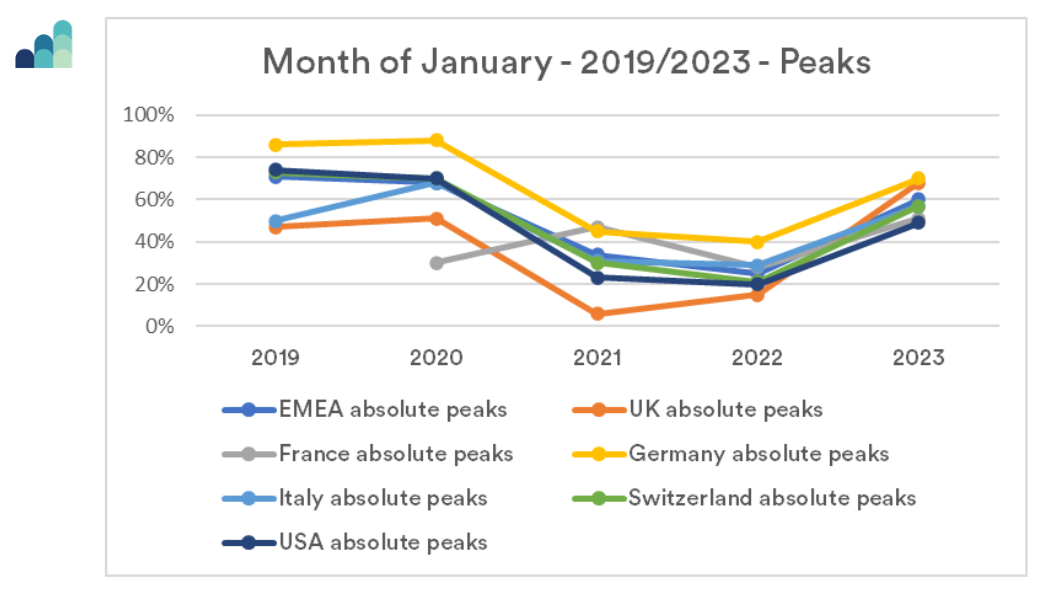

It would also seem that most organizations have taken the note that the office is most useful when it brings people together. Looking at peaks, we can clearly see that for this particular metric, we are approaching, if not surpassing in some cases, the pre-pandemic levels.

As the distancing requirements have faded away, and as the purpose of the office has been reaffirmed for collaboration and face to face interaction, we can see that firms are taking the steps to ensure that people actually come to the office together.

It may also be that overall, the majority of employees elect to come to the office on the same days (i.e. Wednesdays) as this may be deemed most practical – and Mondays and Fridays the office is turned into a ghost town.

But whatever the main reason may be, this results in a clear conclusion when it comes to office space requirements: when it comes to the optimization of the office space, the new normal doesn’t seem to offer added potential compared to the pre-pandemic situation.

It doesn’t mean that there aren’t gains to be made – the pre-pandemic office wasn’t optimized, so that’s likely still available. But additional gains may not be realized with this version of hybrid work.

Get regular insights on workplace trends straight to your mailbox

Omar is the CEO of Affordances, a company that uses a holistic approach to work to solve experience issues for companies.

With a background in facility management, Omar progressed to project and construction management and worked for companies like Netflix, Dropbox, and Stripe.

Listen to the following clips for Omar’s expertise:

A HOLISTIC APPROACH FOR RETURN TO WORK

“Is the notion of bringing everyone back to the office, similar to a religious cult?” – Sabine Ehm

Due to Omar’s religious studies background, he is well-equipped to answer. He thinks that a uniform demand to return to work, without question, is foolish. Employees are voting with their feet with policies like these.

But it’s both sides of the equation. Employees don’t want to be mandated to return to work. But management must activate the office in order to justify their cost basis.

While Covid should have been an opportunity to rethink and re-strategize, that didn’t happen. Now it’s time to focus on synergy between different directives.

HOLISTIC EMPLOYEE RETENTION

“Hyper growth can be really, really great for companies and for investors, bottom lines, but hyper growth can take a [huge] human toll on people.” – Omar Ramirez

Omar notes that when you’re moving in hyper growth, you’re working 68 hours a week. So, in order to balance that, you need to have the systems in place in an overall employee experience ecosystem. And companies usually don’t do that early enough.

Omar discusses how Netflix nurtured trust to help balance hyper growth. Community was important at Dropbox, and therefore, everyone wanted to work there.

At Atlassian, they hold values as their number one. Culture will change as the company grows, but values will remain the same.

HOLISTIC RITUAL AT THE WORKPLACE

“There’s these religious words that are coming into the workplace and HR context now.” – Omar Ramirez

Ritual and gathering are two words that find themselves in the conversation of culture building and company philosophy. But Omar notes it is important to ask key questions when it comes to gathering, in other words coming to the office.

Why, when, how might this gathering take place? This extends further than just a meeting, but into why your company exists in the first place.

If you have good answers to those questions, your employees can act as ‘missionaries.’

HOLISTIC EMPLOYEE EXPERIENCE

“I do think that when you look [at how] work is developing, I think of it more as a holistic employee experience.” – Omar Ramirez

Where we work and how we work is just one part. It is the entirety of experiences an employee has from start to finish, starting with your employee interview, and it ends the day you leave, or the day you exit the company.

For Omar, Netflix set the bar. People say Netflix is a great place to be from. Because anyone that has worked at Netflix has moved on to bigger and better things. The company doesn’t hold you back, but celebrates your new chapter.

That kind of supportive community is a great version of a holistic employee experience.

A HOLISTIC APPROACH TO LEASES

“But for most companies, a five to seven-year lease, or a three to five-year lease, is not going to be realistic.”- Omar Ramirez

Flexibility, diversity, and organic collision is important for the workspace. The sense of collaborating from community working spaces has changed how we work.

We need to rethink how we build and design spaces. If we think of the office like a home, it’s constantly changing. How do we invest in a way that nurtures employee life and also doesn’t destroy the environment?

If companies thought in more of an “eat, pray, love” type of way, both businesses and employees would be better off.

CONCLUSION FOR A HOLISTIC APPROACH TO WORK

Omar thinks in design, which is so often focused on exact dimensions and uses. But he insists on thinking about the entirety of the environment.

He points to the Googleplex built in California. At the time, making everything ‘in house’ was a revelation. A way to improve productivity. But in the end, it hurt all the surrounding businesses. It gave no incentive for its inhabitants to even step outside.

Jens Ebbe Rasmussen’s is Senior Vice President of Business Development at Coor Service Management, a Facility Management leader in Scandinavia.

At Coor, the mission is to create the happiest healthiest, most prosperous workplaces across the Nordic Region. The company does €900M in revenue, has 11,000 employees, and maintains 20,000,000 square meters of real estate.

FACILITY MANAGEMENT AND RETURN TO WORK

“One thing we foresaw when thinking about what would happen [during] the big return was the trial and error period [from] different companies.” – Jens Ebbe Rasmussen

At Coor, Jens designed a three-phase approach to rebounding from Covid.

The first phase was the safety phase. This included anti-viral technology, reducing airborne viruses by 97%, to managing the number of employees in the office.

Afterward came the advisory phase. This meant that any advisor can answer customer questions across company sectors. They built a framework for the most common questions so that any contract manager can have a discussion.

The final phase was making it attractive to return to the office. Jens says the combination of the first two phases went a long way. Unlike companies trying to mandate returns to the office, Coor is set on attracting its employees back to work.

FACILITY MANAGEMENT FOR TODAY’S WORKFORCE

“We’re meeting generations that ask, what’s in it for me? And what’s the greater purpose?” – Jens Ebbe Rasmussen

Jens remembers an interview 25 years ago in which they asked him if he wanted coffee. He said yes and was directed to a vending machine. This simply wouldn’t fly today.

Companies need employees to adapt, be fast, creative, and innovative. But as a company, you must lead by example. The war on talent must start with a complimentary coffee.

Employees at Coor can have a direct line with the CEO. They can work from home if they want to. Covid has made things more difficult, yet also revealed what’s important. With this in mind, it’s up to the leaders to set the stride.

FACILITY MANAGEMENT POST COVID

“Mental Health has become something that companies are more attuned to.” – Sabine Ehm

Jens responds that cleaning services is becoming more demand driven due to automation. It is much more focused, as opposed to general cleaning once a day.

Food services are also evolving. The Nordic countries have been more used to buffet style, but meals are now served. This improves health risks and quality of experience.

At Coor, all services are becoming more flexible in order to serve different customers and sectors.

HOW FACILITY MANAGEMENT HAS CHANGED

“There has been a [desire] to put the supplier and the customer on the same side of the table” – Jens Ebbe Rasmussen

Jens says that twenty years ago, facility management services were more traditional. For example, it was the norm to show services offered through organizational charts. It was a more traditional sales pitch. Cost bases, RFPs, and so on.

But now, it is more about synergy and working together. Flexibility is key, not just for you the customer, but for the facility management business in general. The business is much more about communication and focused attention. The result is cost-effectiveness.

CONCLUSION FOR FACILITY MANAGEMENT

If Jens could find a way to make the facility management industry truly sustainable and climate neutral, that would be his number one priority.

According to Jens, we spend about 36% of energy in the built area. Plastics, other consumables, red meat in the restaurants, different chemicals used are several ways the industry can change.

Since the Nordic countries are a leader in sustainability, Jens is confident the future is bright and that Coor can help continue to lead the charge.

Flexible real estate: the two terms don’t generally go hand in hand. But for Sheila Botting, it’s the only way forward.

Sheila Botting is Principal & President of Americas Professional Services at Avison Young, with previous stints at Cushman and Wakefield, and Royal Lepage. A former partner at Deloitte, she holds a business degree from Harvard and a master’s from The University of Waterloo.

Avison Young is currently the fastest growing commercial real estate firm. Sheila’s mandate is to add professional services. Through her work, Sheila has learned how to best optimize value of an asset. She has also learned that in business real estate, form often follows function.

Listen to the following clips for Sheila’s real estate expertise:

FLEXIBLE REAL ESTATE AS A SERVICE

“What if we actually activated that whole lobby experience, sometimes there’s underground or adjacent buildings attached to it. Let’s activate [it]. So that you want to be in that building.” – Sheila Botting

Creating value for tenants is a continuum. Now that real estate has core and shell, net-zero, and LEED Platinum, those are givens. But how do truly create value for the employee experience?

For Sheila, that’s about maximizing value from overlooked spaces. What if the stairwell was a place for exercise and wellness? A place that no one wanted to spend time in now becomes valuable to the employee.

Real estate as a service is also about outfitting smart buildings. If you have data telling you average vacancy rates based on days employees come into the office more, you can adjust accordingly. This results in improved sustainability and ESG goals.

FLEXIBLE SEATING MODEL

“What came out of Australia, and in Europe, [is that] many companies are moving to unassigned seating models”—Sheila Botting

With the unassigned seating model, because people are moving during the day, you have the space that you need when you need it.

If you need a meeting room or a private office, you have it. The unassigned seating model unlocks the empty space you had before.

Subsequently, the accountants love this because it immediately reduces your footprint on a cost per-employee basis. With those savings, you can instead redeploy those funds, because we know staffing is the largest line item for PNL.

Therefore, redistributing those funds is a net win for the company and the employee.

FLEXIBLE REAL ESTATE ACROSS GENERATIONS

“You go to Bob or Sally [and say] ‘you know that big ego corner office that you’ve worked your entire career to achieve, and it’s got all of your degrees and stuff on the wall? Well, you don’t need that anymore, because we know you’re only sitting there 20 to 30% of the time.’”— Sheila Botting

Will that approach work for the person who has risen through the company over decades?

Many offices have five different generations all working together. For the senior folks who have earned the corner office, perhaps not.

So, ensuring individual requirements are met and achieved requires a thoughtful, methodical change management program.

Going into this model, people are resistant. They want the private office or their typical workstation. But when they go through the process and they see the benefits of collaboration, they are much more enthusiastic.

Sheila says that what is individually sacrificed is made up for by the engagement with colleagues.

FLEXIBLE REAL ESTATE FOR SUSTAINABILITY

“So any organization [can] easily reduce its footprint by 10 or 20%, [even] before COVID. Now, in the new hybrid world, you can probably reduce 30 to 50%.” — Sheila Botting

How do you make your space sustainable? First, start with hard materials: furniture, fixtures and equipment used to procure it.

Another factor is work hours per employee. If employees are travelling during rush hour but choose other times that commute that reduce co2 emissions, you must enable them to do so. Enabling people for hybrid working environments prevents needless travel.

Subsequently, facility management practices are key. The company footprint can be massive, and it’s important to be mindful of paper printing and to encourage electronic transmission.

Lastly, food services with a focus on healthy offerings as well as sustainable disposal. Secondly, look at garbage and waste disposal programs. Are you reducing single use containers? Wellness centers for employees to stay fit.

All of these are net wins for your company and your workforce.

REAL ESTATE IS AN EXPERIENCE

“In the past, we viewed it as an asset, but real estate’s an experience.” – Sheila Botting

Traditionally, commercial real estate was thought of as an asset, as bricks and mortar. Now we have shell and core, but it’s not enough.

It’s about the experience people have in that building.

Now it’s about improving the experience for everybody, whether that’s the ecosystem within or the physical real estate itself. Sheila thinks if we pivot to real estate as a service, that’s the way forward for the next twenty years.

CONCLUSION FOR FLEXIBLE REAL ESTATE

Sheila urges people to get passionate about real estate.

You can now eat, shop, and be entertained from home. Of course, we did that during Covid. But now, everybody’s going to restaurants, or the mall, or to the theatre.

We’re craving community. So Sheila challenges the real estate world to offer the experience to bond. What the user journey is and wants to be will dictate the next two decades.

Well Designed Spaces are Victor Maningo’s forte. He is a trained architect with over 25 years of experience and a passion for architecture.

Victor is Vice President for global market development for International Well Building Institute (IWBI). He has a Masters of Corporate Real Estate and holds a Bachelor Degree of Art in Design.

His primary role is to assist the exponential growth in Asia, a market quickly adopting the WELL building standard.

Listen to the following clips for Victor’s expertise on Well Designed Spaces:

THE WELL BUILT OFFICE ENVIRONMENT

“[I] remember those horrible days of cubicle farms in the 80s and 90s. [Office] spaces are now more experiential, more people focused.” — Victor Maningo

The office must be an environment you want to spend time in.

Victor’s mission is to build community, while still providing a variety of office formats, allowing employees to do their best work.

Technology has untethered us from the old factory work paradigm. In addition, Victor says it’s liberated us from the confines of four walls, with bad lighting and no access to nature.

WELL DESIGNED OFFICES ARE WHOLISTIC

“Another client [gives] healthy recipes, mindful exercises, tips on reducing stress [to their employees]. Those tools are invaluable, not just within the building, but [for] at home.” — Victor Maningo

Companies are encouraging employees to integrate physical activity into their daily routines. More specifically, offices are providing vending machines with a range of nutritious products.

Making snacking healthier and convenient isn’t all they’re doing. In addition, offices offer treadmills and gyms to help employees keep fit.

Moreover, one client developed an app that sends COVID communications. This subsequently provides transparency to the organization and helps keep their employees safe.

WELL CERTIFICATION COMPONENTS

“The standard really is a cross bridge of building science, health science, and behavior science.” — Victor Maningo

Victor tells us the ten concepts for WELL Building: the topics of air, water, nourishment, light, movement, sound, thermal comfort, materials, mind and community.

Through data driven strategies, WELL Building Standard is a full scope approach to create optimal indoor ambience.

Subsequently, WELL certification looks at building performance, operations and management, and how these can come together to have a positive impact on people’s health and well-being.

WELL DESIGNED OFFICES ARE TASK BASED

“I’m currently hearing from clients that workplace solutions are going to be more task based rather than location based.” – Victor Maningo

Because of Covid, demands and expectations are shifting from the boardroom to the supply chain.

Therefore, an organization must empower workers to choose when and where they do their best work. Secondly, for employee retention, companies need to be competitive and offer flexibility.

Lastly, whether it’s in office or at home, HR policies and technology solutions can enable the workforce to do their best.

WELL DESIGNED OFFICES IN YOUR HOME

“You know, the pre-pandemic trend was a ‘resimercial’ scenario. We were making offices look more like our homes, and now we’re going to make our homes look more like the office.” – Victor Maningo

Victor says it’s an interesting challenge for organizations because they’re going to have to pay people to essentially decorate their homes.

With various options including an allowance, stipend, or a methodology, it is unclear what the best solution is.

Yet architects and designers have so much data, it must therefore be utilized for developing workspaces at home and in the office.

CONCLUSION FOR WELL DESIGNED SPACES

Victor’s workplace solution would be finding a way to measure psychological safety.

Stress is subjective and subsequently challenging to observe. Specifically, employees have different tolerance levels and trigger points.

Therefore, if it could be measured individually, it could be dealt with effectively. In the end, it would create happier and healthier workplaces.

Why of the office – and how to make the data work: In the last few years, workplace leaders all over the world have been tasked with more challenges than ever before, and all are searching for new answers to these challenges. A renewed need for congregating in a community of like-minded professionals is very clearly felt across the industry.

While there are dozens of industry conferences and events available to workplace leaders to meet, exchange and learn, these opportunities are often a mixture of both genuine exchange, and representation. All participants must show themselves in the best light possible and promote their work and the company they represent.

At Locatee, we thought that it would be beneficial to our community, to organize a different kind of event – behind closed doors, where no representation is required, and where one can openly express their challenges and statuses.

We organized such a meeting last October, in Basel, at a customer’s campus, and invited select members of our Locatee community to exchange on their current situations regarding their place in their organizations, return to office, technology and data. Here are the takeaways from these discussions:

The “why” of the office

After a number of years of work from home mandates, and establishing policies, and testing various models – office presence models, seating models and so on – we are still discussing something at the heart of everything we do: why the office exactly?

Our participants offered many opinions on the matter: the office creates a sense of community and connection across the organization; the office is the go-to place for collaboration and socialization;

As such, we were given food for thought when a lecturer proposed that, since the office’s purpose is defined by creating more opportunities for personal interactions (that’s the common denominator between community, connections, socialization, collaboration), one role for workplace leaders in that, is to manufacture density.

By shutting down floors, it would naturally cause people to be less separated. This doesn’t necessarily mean putting everyone in a single floor, but simply reducing the accessible space in a safe way, and still maintaining the types of space that are needed for everyone to work their best.

That way, the office is really playing its part.

New ways of working

Our discussions addressed the working models that have been rapidly under the microscope, with hybrid working accentuating the need for new solutions. Our experts reviewed concepts such as Activity-based working and challenged that concept. ABW is centering the office’s purpose around specific activities.

However, the previous discussions established that the true purpose of the office is not only in specific activities but also “in between”. Therefore, ABW may not be the right model, also when looking at the office through the prism of inclusion and mental health support.

What remains is the observation that, with the pandemic, average corporate networks of people have drastically shrunk by 50%; a challenge for workplace leaders is to ensure that these networks return to previous levels in a hybrid world. ABW may actually contribute to reducing these.

Data driven workplaces

Throughout these discussions, the need to support decisions and initiatives with data – and the challenges to have the right data – was ubiquitous:

- Experimenting (small and fast) to learn new ways of working;

- Data is key to:

- Apprehend the challenges and evolutions

- Communicate the reasoning behind decisions / solutions

- Understanding data quality requirements;

- Getting IT on the side of real estate – it is much more likely for IT to understand enough about real estate to support, than for real estate to be able to lead IT things.

We were extremely thankful to our guests for the lively and qualitative discussions as well as for the overwhelmingly positive feedback received. Stay tuned for new editions of Locatee’s community events!

As the Founder of EXT – Experience and Transformation, Tonille started the company during Covid to help streamline her consultancy. At EXT, employee first is key.

Tonille sees work as a verb. It’s a thing we all do, not a place we go. Over the years, Tonille has worked on planes, in cars, at home and abroad. The ‘office’ is the same now as it was ten years ago.

Listen to the following clips for Tonille’s expertise:

EMPLOYEE FIRST REQUIRES A SHIFT

“The way that most of our workplaces were founded [are] from the Industrial Revolution, [going] back hundreds of years ago” – Tonille Miller

Since the industrial revolution, we have had to go to work for our jobs. Our workplaces haven’t really changed much since then.

Except for a small percentage of us in North America, we don’t work in factories anymore. Especially not knowledge and gig workers, yet we’re still expected to report to a specific place of work.

Before the pandemic, our workplaces were already out of date. But the pandemic changed all that. Tonille feels it forced us into the modern era and to rethink what is possible with technology. The purpose of the office needs to be a place to collaborate and build community.

EMPLOYEE FIRST IS KEY TO COMPANY CULTURE

“Culture and employee experience is an extremely strategic lever. It’s an actual strategy that you do and there are activities come out of it” – Tonille Miller

Leaders think culture and employee experience are those cosmetic things like foosball tables or Taco Tuesday. They believe that’s culture and that if you’re not in the office, you can’t have those things, which means you don’t have a culture.

While a foosball table may cause an initial uptick in usage and office engagement, employees statistically lose interest in these things after about one month.

As Tonille says, no employee that’s sick of their manager ever stayed with a company because of a foosball table. Cosmetic things don’t really add value to a company.

EMPLOYEE FIRST MEANS NO KID GLOVES

“Treating people like little kids, I cannot overstate this enough, this is one of the number one factors [fuelling] the great resignation.” – Tonille Miller

During the pandemic, employees showed that they could pivot overnight. During social justice movements and economic uncertainty, no matter what is happening, and be more productive. Employees didn’t even get paid more, yet leaders are tone-deaf. They acknowledge employee sacrifice yet expect work to not continue to be flexible.

People are realizing life is too short, especially Millennials and Gen Z. They live their life in a very different timeframe than folks from older generations. Because all the things they’ve grown up with feel uncertain. They want flexibility and integrate work into their personal lives in a more meaningful way.

INCREASE TRUST WITH YOUR EMPLOYEES

“I’m seeing them increase surveillance and control, which is not helping anybody. In fact, it’s bringing trust way down, if you can imagine, and then trying to replicate exactly how they worked in the office, but doing it remotely. That’s another mistake.” – Tonille Miller

Tonille says mandating employees to come back to the office is a pretty laughable idea at this point. We have two years of pandemic data that proves that work from home works very well. Companies like GitHub and Netflix have been practicing hybrid work for years.

The next thing that needs to change from leadership is decreased trust in their workforce. People on twelve hours of back to back Zoom calls are expected to have their camera on the whole time because that would be the equivalent of them putting in a full shift at the office.

Tonille says this is unacceptable. Zoom fatigue may be a new phenomenon, but it’s very real.

THREE THEMES TO GET TO EMPLOYEE FIRST

“In a hybrid world, you have to be much more transparent, give candid feedback [in real time]. Push information as low in the organization as possible. Netflix is great at this. It allows everybody to feel part of the organization. It also helps everyone drive the business forward” – Tonille Miller

Tonille says leaders need to get their heads around working asynchronously. They need to employ technology more effectively, because we have it, but leaders just aren’t comfortable with it.

At EXT, there are three themes for employee first mentality. The first is transparency. The second is autonomy. So increasing autonomy, agency, and accountability. The third is having a clear vision and giving employees problems to solve. Give them guiding principles and then let people figure out how to get there.

CONCLUSION FOR EMPLOYEE FIRST

The leaders must light the way. They need to be role models. The sad thing is the disconnect between what they expect and what they do.

Leaders get excited after buying a new platform because it’s going to save them money, or it’s going to show them all kinds of benefits for the company, but they’re not willing to do that role modeling for the employees.

They expect their employees to change, but aren’t willing to put in the work themselves.

Raimund Paetzmann is Vice President of Logistics and Network Expansion at Zalando SE Berlin and an expert at balancing logistics.

Starting at Amazon in 1999, Raimund is an e-commerce pioneer, being a part of its growth from $600 million net sales to $130 billion in 2016, and helping build the most advanced ecommerce logistic network in Europe.

In June 2018 Raimund also became Vice Chairman of the Committee on Logistics Properties in the German Property Federation.

Listen to the following clips for Raimund’s expertise:

BALANCING LOGISTICS IN REAL ESTATE

“We live in a world where sustainability is important, yet the carbon footprint of having an office utilized at 50%, is [that the] right thing?” – Raimund Paetzmann

Corporate real estate in 2022 is a balancing act. Is it the right thing to keep all this office real estate? Perhaps, if the company cashflow allows.

But for many companies, it is better to sell off a decent portion. With housing crises in many major cities, the question is perhaps building more residential real estate, as there is no shortage of office spaces. These are the challenges Raimund and others in logistics face.

If you ask Raimund whether companies currently have the correct answer, he truthfully answers that they don’t. It’s a huge shift and still a work in progress.

BALANCING THE LOGISTICS OF MEETINGS

“There was an interesting observation that [those who met] in the office [remembered more of] meetings. Because you’re always in the same room, you have no system, you just switch from one call [to the next]” – Raimund Paetzmann

Balancing logistics of whether to meet in person or over Zoom is now a common question. A recent study says that those who met in person remembered more from meetings than those who met exclusively online.

Even during Raimund’s time in lockdown, he came away thinking that he was not taking as much from the meetings as usual. He said that while he was meeting more than ever, he was always tired.

It’s a matter of quantity over quality. While it’s possible to fit in more meetings on zoom, they are less memorable (and potentially less effective). This is because you’re static in your chair without a change of scenery or much real-life socialization.

BALANCING HYBRID LOGISTICS

“I want to get a neuroscientist on because I think this is very basic. [I think they] could probably explain why things work well and [why others don’t], no matter how hard we try to make it work in the hybrid scenario.” – Sabine Ehm

Raimund says you should have moments that matter. You should talk to people without a screen. But it’s also important that in-person events and meetings have purpose. It is not enough to just have social events without a call to action.

The needs of introverts and extroverts is also a consideration. Is an event that is more of a party going to attract introverts? Probably not. At the same time, a more work-focused event may not draw the extroverts in.

It’s all about finding the balance that compliments the company mission.

OPEN PLAN DOESN’T WORK FOR LOGISTICS

“Maybe we’ve been on the wrong track, [focusing on] this huge open plan. In start-ups, the first 100 people work together, it’s like a ballroom. It’s a nice atmosphere and you like it. But as the company grows, it’s not so nice anymore.” – Raimund Paetzmann

Raimund thinks that many workers don’t want to return to the office because of open plan design. The office is too loud and noisy. They can work in silence from home.

He also thinks we have to rethink how we design offices in the future. Design them better for departments to enable a serendipitous exchange. Allow spaces for flip charts and whiteboard sessions. Get all the ideas for the week out there and coordinate your team accordingly.

FUNDAMENTAL CHANGES AFFECT LOGISTICS

“There is this bridge, but the riverbed has moved. Sometimes you have such fundamental changes about your fundamental beliefs, because everything is changing, and you have to adapt, because even the water can go.” – Raimund Paetzmann

Sabine recalls an event where Raimund showed a striking image when he was a conference keynote speaker.

It was of a bridge with no water underneath, as the riverbed had dried up. This is an analogy for the office space in 2022 and its relationship to its workforce.

Raimund insists company structure cannot be written in stone. Companies must reinvent themselves and be creative and develop new ideas. They need to constantly question the way to move forward.

CONCLUSION FOR BALANCING LOGISTICS

If Raimund could fix one future of work issue, it would be the amount of regulations for corporate real estate. If a company needs to knock walls down, or conversely, put walls up, there needs to be a faster process to enable them to do so.

Raimund doesn’t want to break rules, but perhaps be allowed to bend them at times, or make them more flexible. Not moving the whole building, but moving parts of it.