Building a strategy framework with performance metrics

Long-term strategic planning is still rare in Corporate Real Estate, as data-driven frameworks have been missing as a basis to make informed decisions and develop a sustainable strategy. With the rise of big data however, a broader range of options for efficient and accurate data collection have become more widely available in recent years. These options provide corporate real estate professionals with a new set of tools and know-how that can be employed to inform goal setting.

Unfortunately, actual long-term strategies for corporate real estate are still quite rare. In most organisations, real estate departments continue to rely on annual operating plans addressing only the most pressing space issues, all the while feeling a lack of depth and breadth of data, and appropriate frameworks to propose a holistic property strategy.

The process of bringing such a strategy to life therefore begins with consistent data reporting in order to understand the current state. The following step is to identify the desired return on investment, justifying the corporation’s need to change course. These performance metrics make sure that the company is heading towards its fundamental goals in the long term.

Thus, organisations need to thoughtfully determine which business results matter most, so they can select and report on key performance indicators (KPI) that measure their success in managing their real estate portfolio.

At the forefront of interest is of course cost as many organisations aim to streamline and reduce their portfolio size, doing more with less and manage costs better. Accordingly, real estate cost are tracked by almost 90% of companies as reported by CoreNet’s KPI survey in 2014 “Understanding business performance indicators”, alongside space efficiency metrics that 88% look at.

But to guide directives to strategic planning requires more informative reporting than just size and cost of the portfolio. Ideally, the corporation views real estate as a productive resource and uses business investment to impact productivity and add value to the business. Therefore, workspace utilisation, employee satisfaction and productivity are important metrics to determine how particular buildings perform and contribute to the core company, beyond financial impact.

When building a compelling case to consult the C-suite and to influence smart real estate decisions, access to reliable data and facts is indispensable.

With the rise of big data, a broader range of options for efficient and accurate data collection has become more widely available in recent years. These options offer corporate real estate professionals a new set of tools and know-how that can be employed to inform decision-making and goal setting.

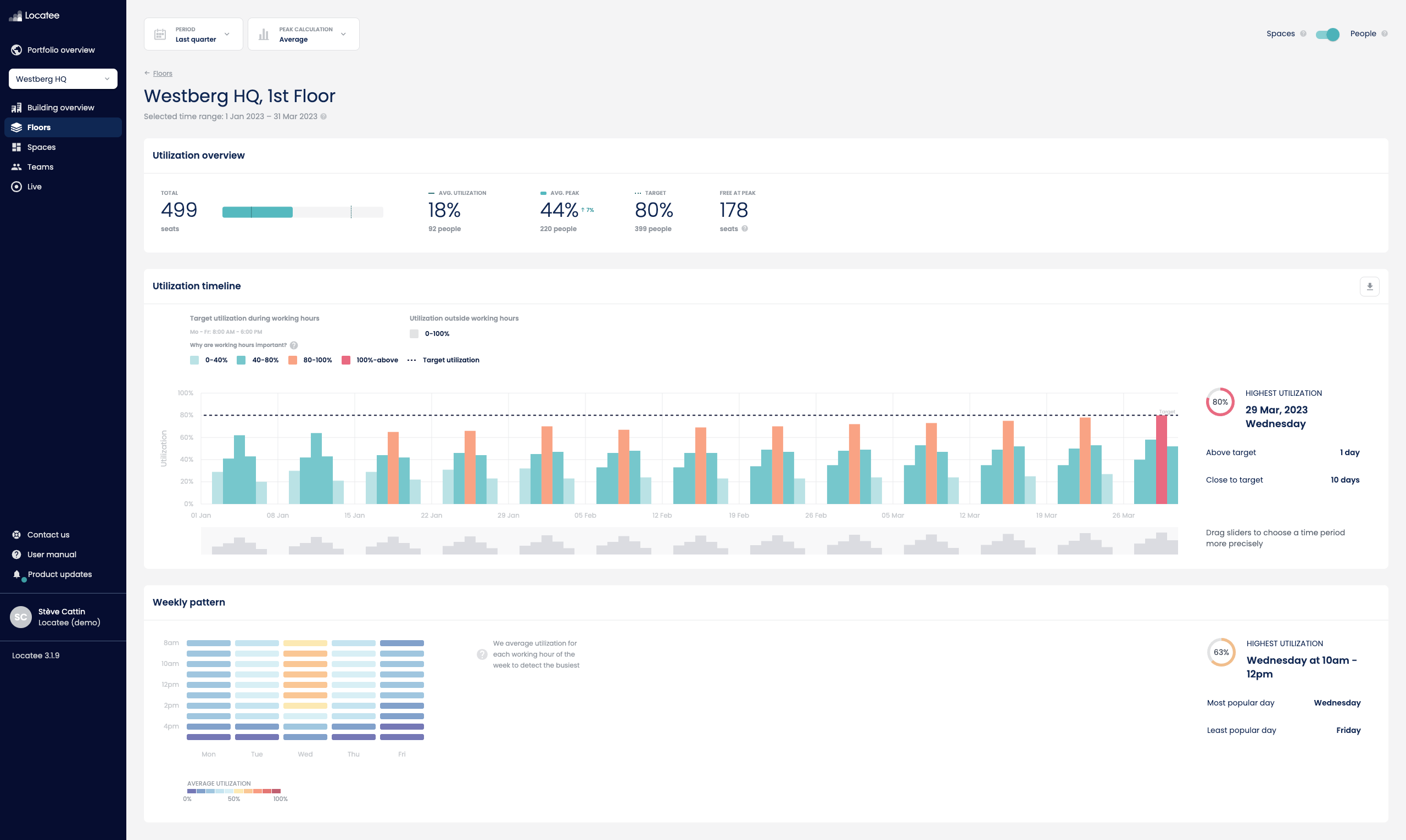

Continuous utilisation measurements for instance provide Corporate Real Estate Management not only with information on how many seats are used during the day on a recurring basis, but also give insight into whether the workplaces provided fit the employees’ needs and therefore contribute to business value.

Does your organisation also lack the depth and breadth of data to define and measure KPIs? Would you like to learn more about how you can use Locatee’s Workplace Analytics solution to provide your organisation with accurate performance metrics?

At the forefront of interest is of course cost, in an attempt to do more with less and manage costs better, many organisations aim to streamline and reduce their portfolio size. – Sabine Ehm

Download the Metrics Cheat Sheet for the Modern Workspace

A short guide to the 7 most relevant utilisation KPIs in corporate real estate management.

A short guide to the 7 most relevant utilisation KPIs in corporate real estate management.

The following KPIs are covered in this Cheat Sheet:

- Current Utilization

- Average Utilization

- Peak Utilization

- Required Workplaces

- Opportunity

- Sharing Ratio

- Optimal Sharing Ratio

3’

3’